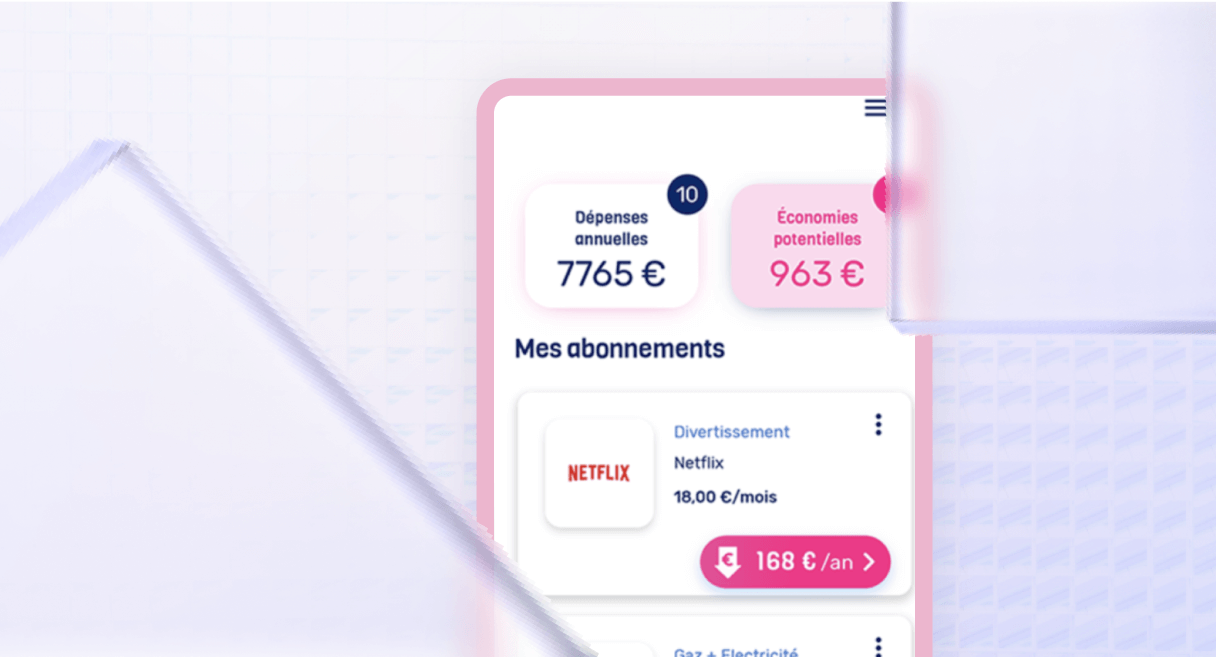

Faced with the boom in the subscription economy, Origame has set itself the task of guaranteeing financial and administrative ease-of-mind for private individuals. This start-up offers a subscription management application, halfway between a budget management application and a virtual administrative assistant. For the crucial stage in the user journey, Origame has chosen Powens’ Open Banking solutions.

The need: encourage users to automatically synchronize all their subscription contracts

With energy providers, ISPs, phone packages, insurance policies, electronic toll services, gym subscriptions, or video streaming platforms, each French person has an average of 12 subscriptions. The administrative burden and expenditure therefore run up rapidly.

Origame enables subscriptions to be centralized on a dashboard thus facilitating decision-making: keep the most relevant subscriptions, cancel others, search for more advantageous alternative contracts and manage new subscriptions.

The application works in 3 steps:

- Add subscription contracts on the platform

- View and audit subscriptions

- The Origame team manages administrative formalities to cancel contracts and change suppliers

For the first, most crucial step, in the journey, the Origame team sought to collaborate with an Open Banking API provider. The aim was to offer users an alternative to the time-consuming chore of manually adding contracts: the automatic synchronization of their subscription contracts data.

The solution: the aggregation of banking data

Powens’ Bank product was incorporated into the application in March 2021, a year after the application was launched. Instead of searching for their contracts and declaring them manually in the application, users just need to log on to their respective bank accounts and explicitly allow Powens to transfer the data to Origame.

The payments related to the various subscriptions are then identified. Users and the Origame team have a clear view and can perform an audit to highlight price increases as well as less expensive alternatives.

“We were won over by the bank coverage in France and Europe as well as the very positive feedback from other B2C fintech players who use Powens’ solutions. We were also convinced by the human fit with the teams.”

Hugo Salard, co-founder and CEO

Promising results

Figures as of July 2022

- 35,000 registered users

- 40% of users use bank synchronization

- €600 savings on fixed charges on average per active user per year

- €650,000 in total savings since the launch

Origame now aims to reach 500,000 users within 3 years while increasing the average amount of savings. The start-up is enhancing its offer by including home insurance, automobile and motorbike insurance, income protection insurance, mutual and borrower insurance services from September 2022.

Origame plans to incorporate additional Powens products over the coming months to further improve the service.

Another major project is the start of Europeanization in 2023. Origame will start with the deployment of its business in Spain, still using the connectors deployed by Powens.

“One of the testimonies received by the team is that of a mother who was able to speed up her plans to travel to Japan with her 3 children. With Origame, she saved the equivalent of 2 years of savings in less than a year.”

Hugo Salard, co-founder and CEO

Do you want to tap into the potential of Open Finance?

Schedule a demo

Nov 22, 2022

Nov 22, 2022