Handling property management payments can seem like a simple task to the untrained eye. Just rent out living space to qualified tenants and collect their rent payments every month through a digital portal.

But anyone dealing with rent management and payment reconciliation at a larger scale knows better.

The reality is that a sizable chunk of French real estate comprises properties used as long-term residential rentals. Global Property Guide reports that over 40% of residential properties in Metropolitan France are occupied by tenants, with a close split between the private rental sector (22.8%) and the public rental sector (17.4%).

At the same time, the report also reveals that growth in apartment prices has “significantly outpaced” the growth in rents, in part due to how heavily regulated France’s rental market has become. Rental supply has also fallen, even as the pool of renter households has steadily increased by 240,000 new tenants over the past 10 years.

This growing imbalance between rental demand, price regulation, and a limited housing supply places increasing pressure on property managers to maintain precise financial oversight. With more tenants and transactions to track, reconciling rent payments manually turns into a time-consuming process prone to costly errors. The ability to match each payment to the correct tenant or property can quickly become a serious operational hurdle as a property manager’s portfolio grows in size and complexity.

The current status of building management processes

Proptech has made significant strides beyond the traditional features of building management. The property management process has transformed from paper-based to digital, with many solutions for automating rent collection and integrating banking and accounting information.

Where property management software still lags, however, is in payment reconciliation automation.

Gaining clear, real-time oversight of cash flow can give property managers far greater control over their business finances. It matters even more for property managers handling payments from multiple sources. You need to know where payments come from to properly credit tenants’ accounts or seek out late payments from non-compliant tenants.

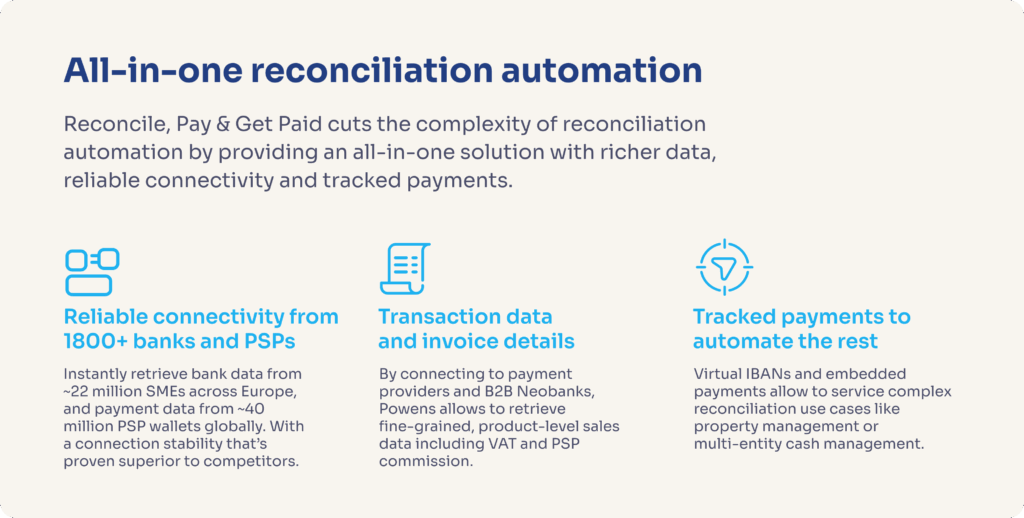

Virtual IBANs (vIBANs) offer a critical solution for this very challenge.

The Virtual IBAN use case for property management payments

Collection of rent payments and property charges is inherently difficult.

Wire transfers make it easy to receive payments directly, but fail to make it easy to track sources or automate reconciliation. With classic wire transfers, all payers (tenants, for example) manually enter their transfer details. In that case, the only way for the beneficiary to know who sent the payment, and to identify it automatically, is to expect the payer to provide a very specific description in the transfer details – like a reference number. But many payers fail to do it correctly. The more buildings and tenants you have, the quicker you’ll start to see a pile-up of multiple, disorganized transactions on your bank statements. This gets even more complex if you have tenants who rent multiple properties from you or make payments via different accounts.

Whether you are a proptech software provider yourself or a large property management agency looking for better accounting solutions, Virtual IBANs can help simplify this reconciliation process.

What is a Virtual IBAN, and how can it help?

Open Finance technologies are helping to reinvent accounting processes in property management. Embedded payments, an important feature of Open Finance, have made it possible for proptech software to embed dedicated payment accounts into their solutions for property managers and landlords. That means that landlords and property managers can open dedicated bank accounts in a matter of seconds by clicking a button on their software.

A Virtual IBAN is a prime example of the innovative prowess of Open Finance.

Virtual IBANs provide users with a unique digital account number. They act as an address: each Virtual IBAN looks like a different account, but in fact, they all redirect to the same “physical” account that’s managed directly in the software. In practice, this allows you to attach a specific Virtual IBAN to each building, tenant, or payee, making it easy to track sources as rent and other payments arrive. Usually, the property management software will propose this option each time you create a new building or tenant file.

You can also take this a step further to assign unique vIBANs for each specific payment category of your tenants. For instance, you could give tenants one unique vIBAN to make monthly rent payments, one to cover maintenance fees, and another for utilities. There are often no limits to the number of Virtual IBANS you issue, and the process is instant.

Creating these explicit vIBANs (e.g., to identify which property it relates to) facilitates reconciliation automation significantly. This translates into major reconciliation time savings, which, for large property management firms, can even add up to multiple days per month.

Using IBANs for payment reconciliation: Unibo’s success story

One company that has already found great success with IBANs is Unibo, who teamed up with Unnax (a Powens Group Company).

Unibo offers a digital account solution for property managers to streamline expense and income management. Like a neobank for property managers, if you will. The proptech company wanted to take advantage of a gap in the market by offering custom accounts and advanced reconciliation features. Designed for property management, these accounts increase convenience and efficiency for users managing all finances within a building, all through a seamless digital portal.

The only problem was that for Unibo to provide IBANs themselves, they would face heavy regulatory and licensing requirements. The solution? To work with an embedded payments provider that offers both IBAN issuing services and regionally specific compliance support.

Unibo found this provider in Powens Group* and has fully implemented IBANs as a solution for payment collection. Launching the IBAN-based solution in 2022, Unibo witnessed an incredible 15X growth spurt a year later in 2023.

“We weren’t just looking for a company or a service provider, but a partner because we wanted to build something big, something that you can’t build with someone who sees you as just a customer.” — Pedro Garcia, CEO & Founder of Unibo

Read Unibo’s full success story here.

*IBAN and payment solutions (including vIBANs and SDDs) are provided by Unnax Regulatory Services EDE, S.L. under its electronic money license (Bank of Spain registration code 6719).

Using Embedded Payments to power Virtual IBANs

Open Finance and its embedded financial features offer tremendous benefits to property management.

Powens Group harnesses the strength of Open Finance to offer clients automated payment collection and real-time reconciliation capabilities. Through our services, you can issue dedicated Virtual IBANs for each individual tenant that all connect back to a main account for holding funds.

Payees can make payments with the methods they prefer. Our solution supports recurring SEPA Direct Debit (SDD), SEPA credit transfers, pay-by-link, and account-to-account transactions.

Property management firms can also leverage Open Banking via the financial data aggregation solution to optimize fraud prevention (by verifying account ownership) and payment collection – for example, pulling SDDs when tenants have sufficient money on their account to avoid missed payment fees.

But when it comes to basics, Virtual IBANs are the ideal solution. For rent collection and other property-related charges (such as utilities or repair costs), vIBANs can quickly increase properties’ and landlords’ financial visibility with:

- Easy identification of which payment belongs to which tenant

- Confirmation of payments made on time, late payments, and overdue payments

- Reconciliation of payments from multiple sources, such as rent for a property shared by two or more tenants who share the lease but pay from separate bank accounts

At Powens Group, our Open Finance platform reinvents banking and payment journeys. We offer both traditional IBAN and Virtual IBAN solutions so that you can make your financial operations as seamless as possible, whether you’re transacting domestically or cross-border.

Want to see our platform’s automated payment collection and reconciliation in action? Book a demo now.

Dec 01, 2025

Dec 01, 2025