- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Real-time revenue-checking solution for better credit decisions

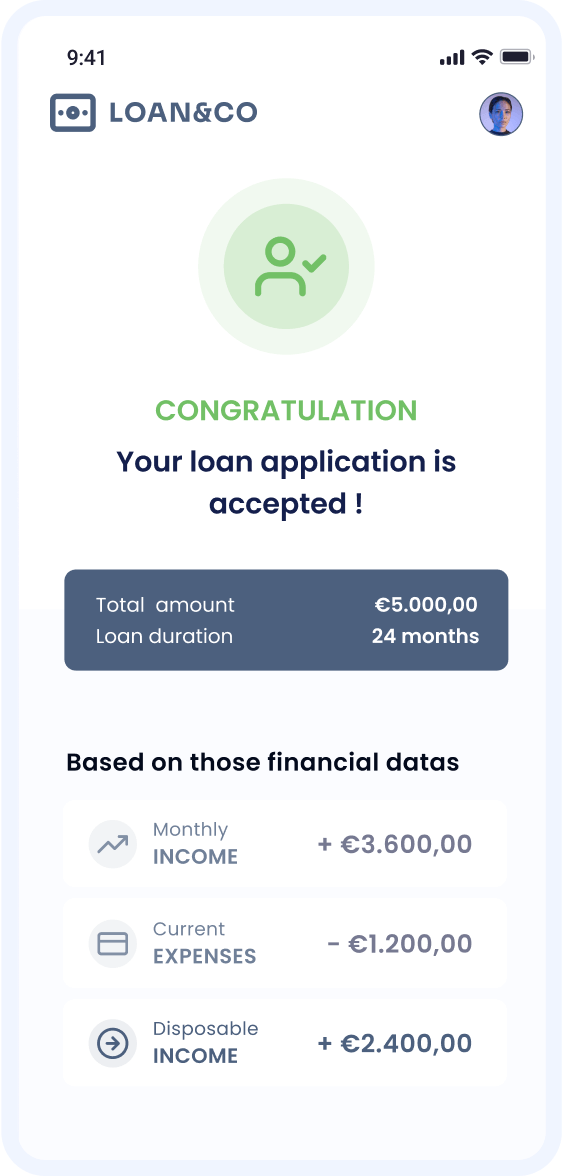

Advisory by Powens allows online credit providers to evaluate their clients' financial profiles in an instant! Get access to categorized transactional data.

Enhance the borrower experience

Allowing borrowers to quickly prove their credit-worthiness reduces application processing time and accelerates “time to yes”.

Improve credit scoring

Doing the heavy-lifting of data categorization not only provides better data for making better credit decisions, but it also frees up internal resources to stay focused on growing your core business.

Reduce risk & fraud

Gaining access to High-quality, up-to-date, and accurate transactional data both improves credit scoring models while allowing you to assess risk and minimize the potential for fraud better than ever before.

What’s in Advisory?

Instantly build accurate financial profiles for individuals and businesses

- Income:

– Monthly income

– Disposable income

– Salary

– Retirement

– Rental income

– Investment income

– Social Security benefits - Expenses:

– Constrained monthly expenses

– Rent

– Energy costs

– Water expenses

– Consumer credit

– Mortgage loan

- Household category:

– Childcare expenses

– Child support - Savings:

– Monthly savings

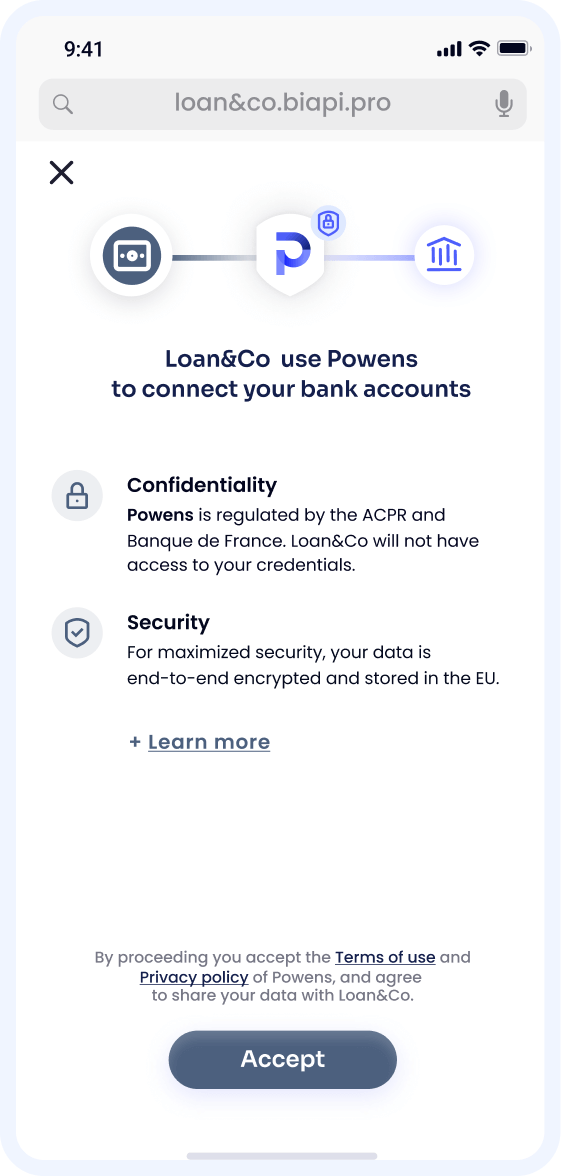

How borrowers give access to their banking data

We ensure all user accounts are easy to connect and always available.

Webview link URL

https://walleto.biapi.pro/2.0/auth/webview/fr/connect/security?s=eyJjbGllb

1

Security & consent

We take your users by the hand by building trust and making sure they consent with confidence.

2

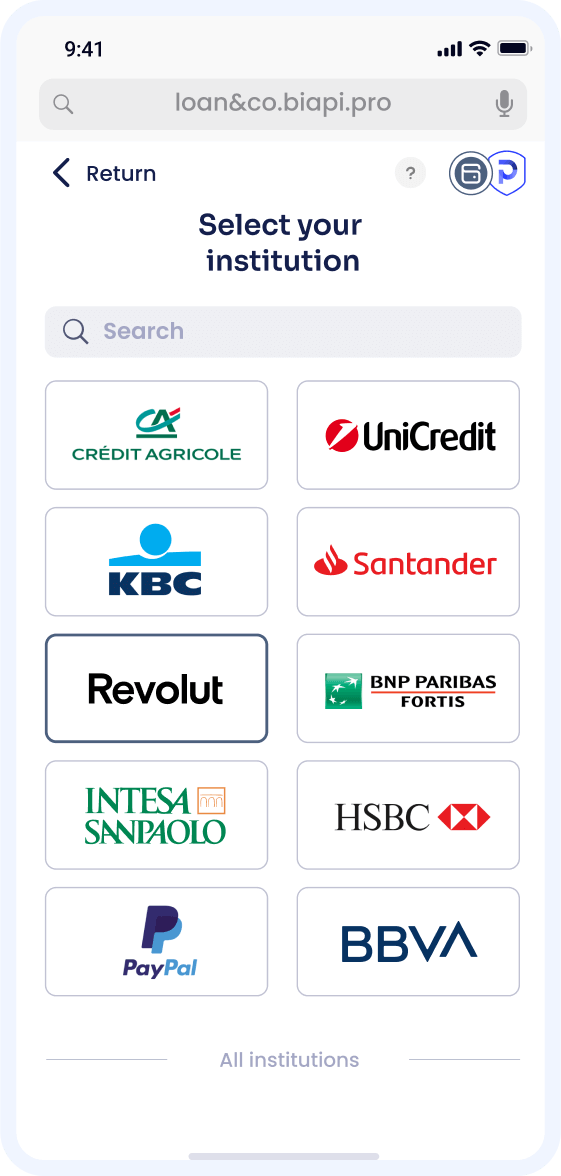

Bank selection

Users quickly find their bank: we highlight popular ones and provide a blazing-fast search experience.

3

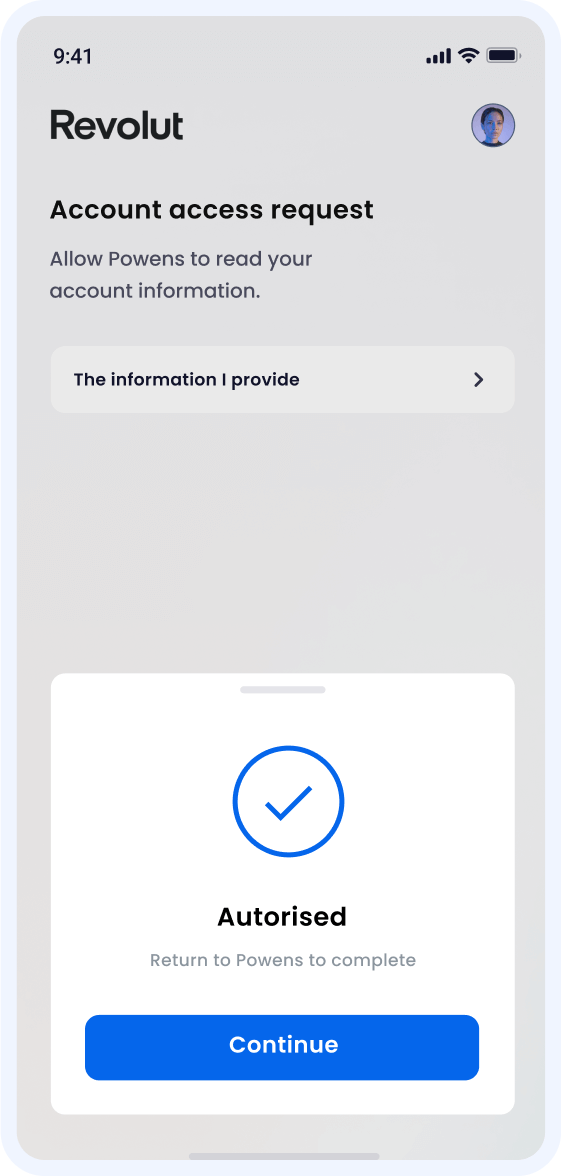

Authentication

App-to-app, web redirection, embedded: our API makes it easy to fine-tune the perfect authentication flow for each use case.

4

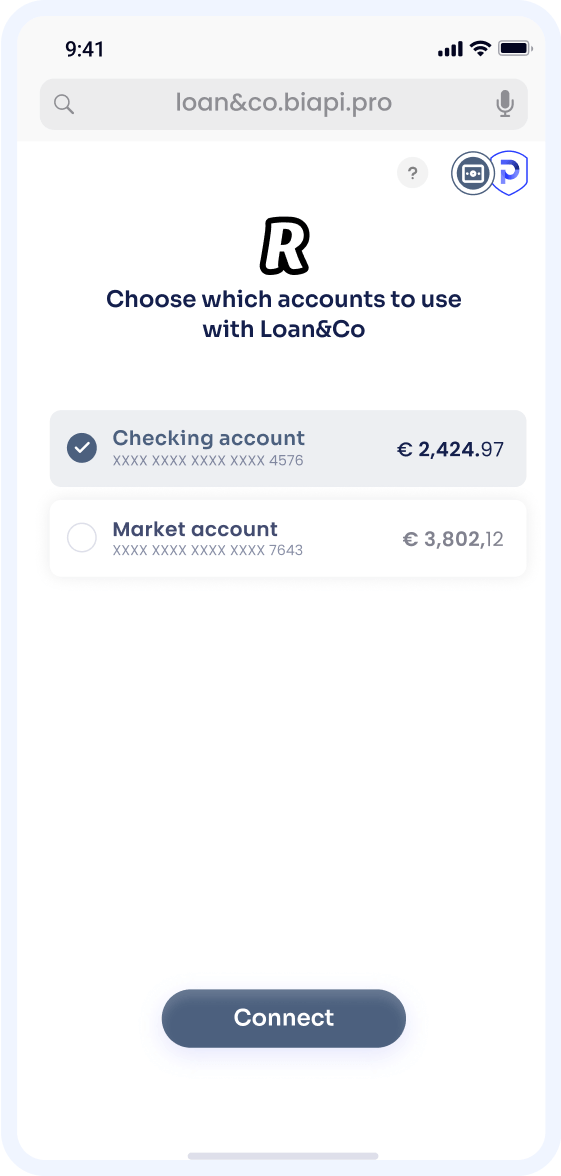

Account selection

Users can select only the bank accounts they wish to share, making our consent flow fully GDPR-compliant.

5

That’s it!

After the user is validated through the bank’s mobile app or SMS code, transactions and balances are instantly retrieved.

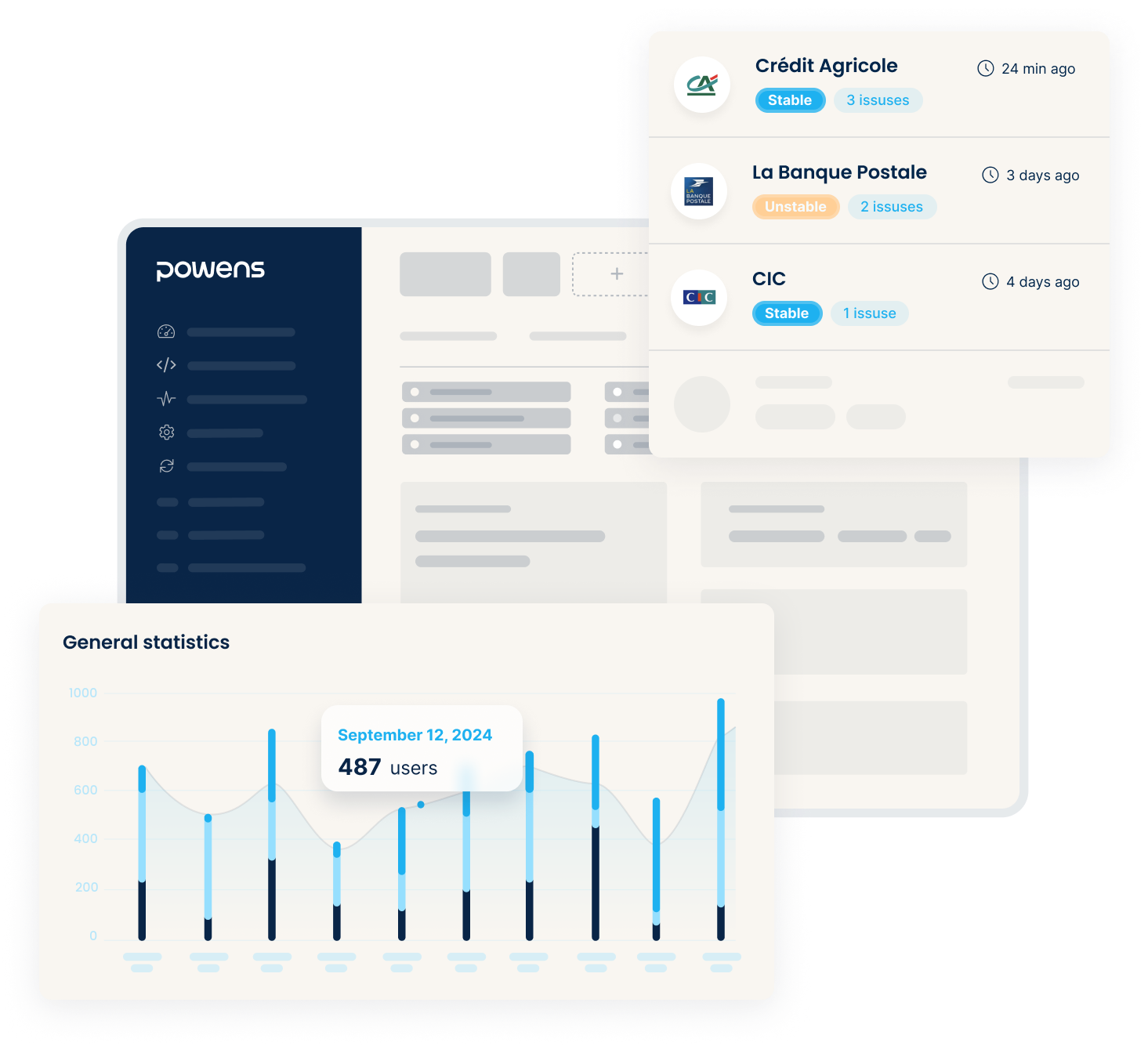

Powens console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Set up a free sandbox in a few clicks and follow the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync use and keep an eye on health statuses.

Analyze

Visualize key metrics and trends to optimize your open finance experience (amounts, users, conversion rates...)

Powens by the numbers

2012

Expertise

260+

Clients

7M+

End-users

1.2B+

API Calls

1.3B+

Payments

Top use case using Advisory