- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

A range of solutions, from data to payment

Data & Document Aggregation Solutions

Access the most accurate financial data from multiple sources in a fully-compliant way.

Data Processing Solutions

Create engaging, completely frictionless experiences for end-users.

Accounts & Payment Solutions

Provide Accounts with local IBANs. Embed Pay In / Pay Out payment solutions.

Best-in-class tech standards

Committed to delivering the highest quality standards on the market, so you can build industry-leading financial services experiences.

Highest quality rate

11 M+ accounts, including 3M wealth accounts synced daily, offering a 99.5% Data refresh success rate and a 99.95% API availability rate for 11+ years.

Powens Console

Powerful admin interface with advanced environment management capabilities, providing detailed issue stats, data logs, and connector health tracking.

Multi-Source Connectors

End-to-end tested with real bank accounts (80% of our connectors). New releases are battle-tested with our users first (with a focus on key countries).

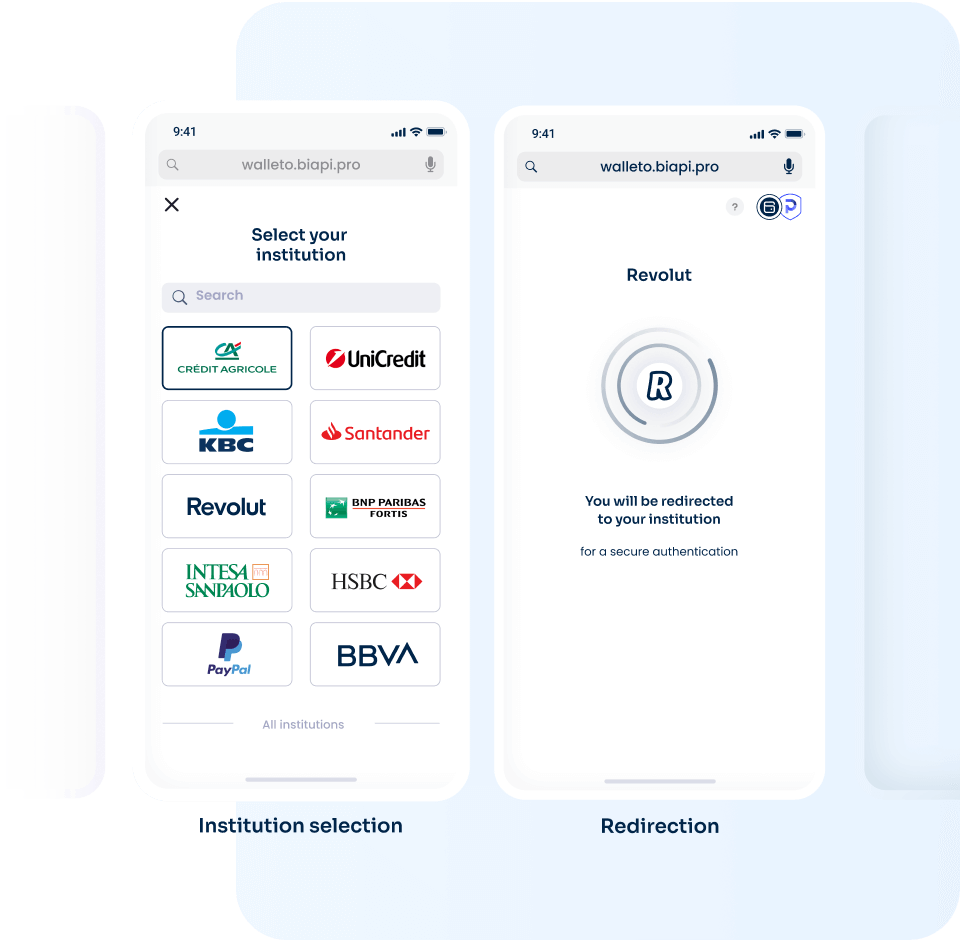

The Webview: Bank connection UI

The Powens’ Webview is a best-in-class and responsive

consentement user interface, tailored to:

- Optimize conversion rates

- Give confidence in Open Banking

- Reassure about the security and confidentiality of data

- Make it easy to choose connectors

- Explain what what strong authentication, or SCA is

- Allow users to manage their connections

- Reduce the waiting feeling inherent to the connection process to an institution

Bank-grade security

End-to-end encryption

Regular security test & audits.

Dedicated deployment options

Get a 360° view of ALL your multi-banked customers’ financial products

A trusted third-party provider

Powens is an authorized payment institution. Our account aggregation and payment initiation license under PSD2 is passported across 30 countries in Europe, the EEA, and the UK.

Our three-part customer journey

Status

Partner

A turnkey user journey with customization elements.

• Customizable Powens’ Webview.

• Powens handles all compliance obligations.

01

/ 3

Status

Agent

A customizable user journey and ACPR registration.

• The client can customize the user journey.

• Some mandatory information and technical criteria have to appear.

02

/ 3

Status

White label

A fully customizable user journey.

• Fully customizable user journey. Powens is just your provider.

• An eIDAS certificate is required for your enrollment with the banks.

03

/ 3

Always by your side

Go live quickly and securely. From day one, as your technology partner, we’ll work with you to create the best embedded finance experiences for your apps.

11+ years of experience with banks and fintech companies

Deployment driven by a dedicated Solution Engineer Team

Business goals optimized by the Customer Success Team

Best-in-class Support Team

Comprehensive, all-in-one solutions

From Data to Payment