- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Effortlessly Manage Payments from Your Accounting Software

Seize control of your payout flows, easily initiating payments directly from your accounting or financial software. Access local and SEPA payment rails while getting comprehensive oversight over your transactions.

Automated payments

Issue fully automated payments 24/7 by integrating our API to your systems.

Bulk payments

Optimize your payouts by scheduling your payouts, whether one-offs or in batches.

Automatic reconciliation

Your payouts are automatically reconciled in real time, ensuring accurate and hassle-free accounting management.

Key Features

Efficient payout payments solutions for streamlined financial operations

- Connect to SEPA Payment Rails

Explore our comprehensive SEPA payment solutions, including Core & B2B direct debit as well as instant and ordinary credit transfers, tailored to various industries for both single and recurring payouts. - Run payments with full control

Unlike Payment Initiation Service Providers (PISP), the backing of an Electronic Money Institution allows you to automate payments easily and transparently thanks to direct connection to the clearing house, eliminating intermediaries for smooth transaction handling. - Assurance of Fund Receipt with SEPA Credit Transfers

Receive certificates of receipt of funds with our SEPA credit transfers, providing assurance that your funds have reached their destination account, protecting you in legal claims and ensuring transaction defense.

How it works

Our Payout solutions are managed via API, which can be integrated within just a few days:

[

{

"wallet_id": "28cd89ed-3ee8-4d91-924b-ce9a31169e1c",

"name": "My First Wallet",

"balance": {

"currency": "EUR",

"amount": 10000

},

"outstanding_incoming_balance": {

"currency": "EUR",

"amount": 10000

},

"outstanding_outgoing_balance": {

"currency": "EUR",

"amount": 10000

},

"description": "Description of my first wallet",

"status": "ACTIVE"

}

]

1

IBAN Account Opening

We provide you with an IBAN account to make it easy for you to initiate payments

2

API Integration

Integrate our payment API with your backoffice (ERP, CRM, TMS, etc.).

3

Send Payments

Start launching payments automatically from your system. Payment management becomes fast and efficient, allowing you to focus on your business.

4

Real-time Notifications

Monitor in real time the status of your payments through fund receipt notifications and certificates, providing you with the confidence that your funds have reached their destination account.

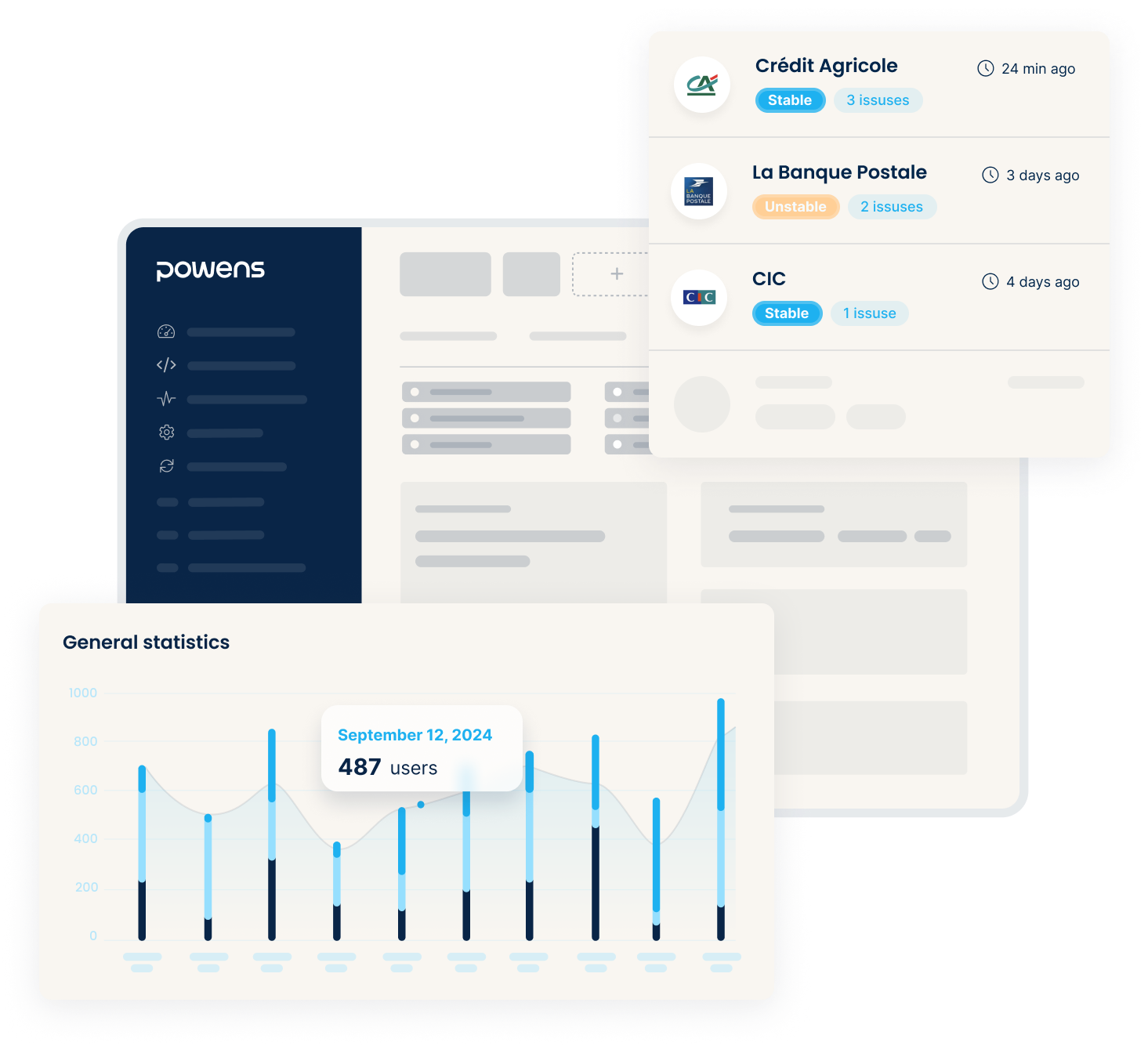

Powens’ console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Setup a free sandbox in just a few clicks and use the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync usage and keep an eye on health status reports.

Analyze

Visualize key metrics & trends to optimize your Open Finance experience (amounts, users, conversion rates...).

Powens by the numbers

2012

Expertise

260+

Clients

7M+

End-users

1.2B+

API Calls

1.3B+

Payments

IBAN and payment solutions are provided by Unnax Regulatory Services EDE, S.L. under its electronic money license (Bank of Spain registration code 6719).