- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Data Processing Solutions

Data Processing Solutions Create a seamless

financial assessment experience.

Our solutions enhance efficiency for over 260 financial firms, offering automated processing, improved risk management, and faster decision-making. They also facilitate client financial assessment, spending analysis, and expedite onboarding by confirming account details.

Advantages

Enhance the borrower experience

Allowing borrowers to quickly prove their credit-worthiness reduces application processing time and accelerates “time to yes.”

Improve credit scoring

Doing the heavy lifting of data categorization not only provides better data for making better credit decisions, it also frees up internal resources to stay focused on growing your core business.

Speed up application & onboarding

Create a frictionless experience by eliminating manual user declarations through simple user authentication from his or her banking institution.

Range of products

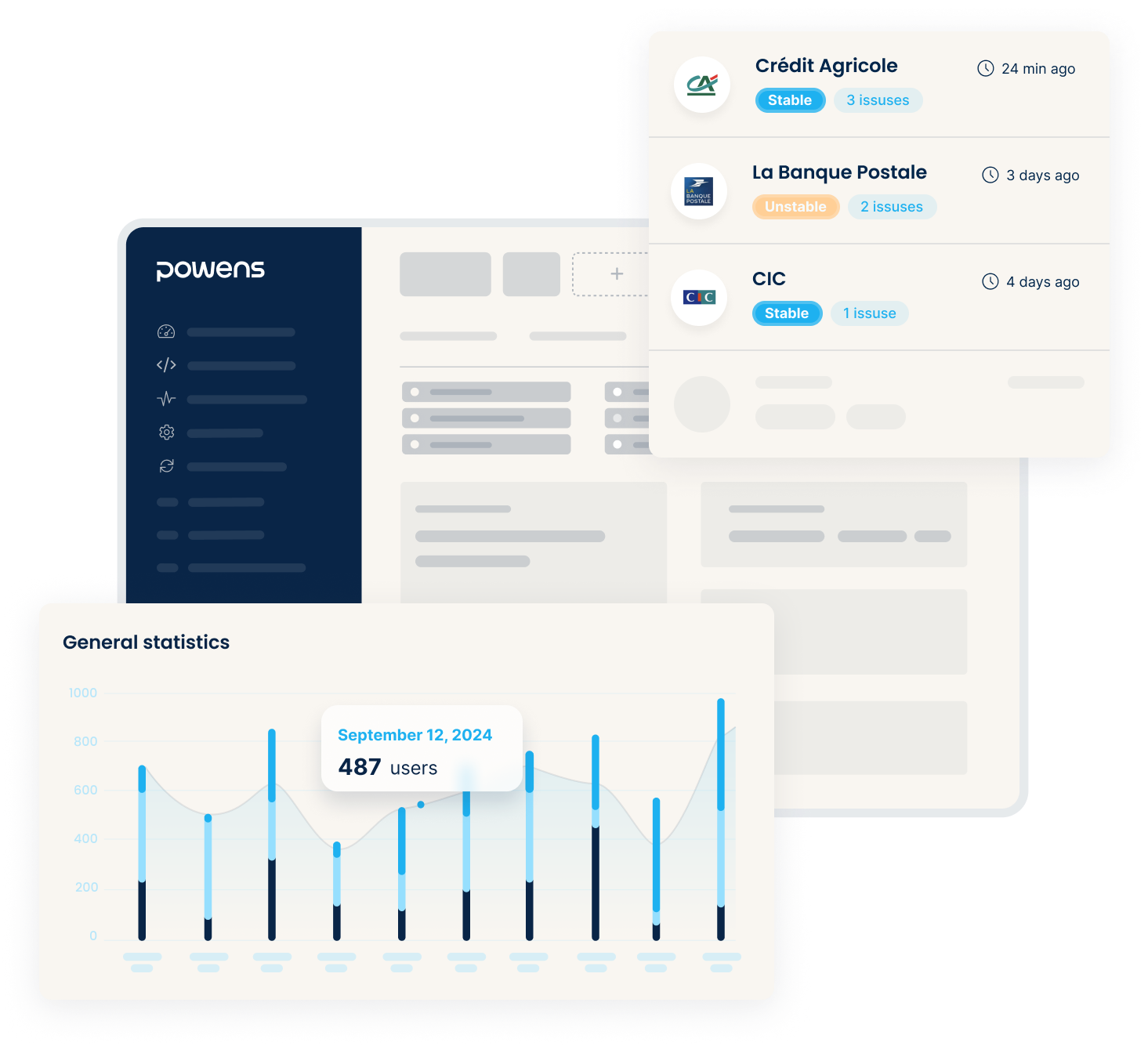

Powens console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Setup a free sandbox in just a few clicks and use the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync usage and keep an eye on health status reports.

Analyze

Visualize key metrics & trends to optimize your Open Finance experience (amounts, users, conversion rates...).

Powens by the numbers

2012

Expertise

260+

End-users

7M+

End-users

1.2B+

API Calls

1.3B+

Payments