- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Identity Verification Solution

Identity data extraction & automated document retrieval for smooth and secure onboarding processes or credit applications.

Speed up onboarding

Streamline the user journey by eliminating the hassle of going back and forth to retrieve the correct documents. Reduce the number of user steps and get the right documents instantly.

Minimize fraud

Avoid fraud risk and fight against financial crime by automating the retrieval of identify verification documents and data directly from the source.

Reduce errors & save time

Simplify information regulatory requirements, retrieve clean documents from the source, and reduce errors related to manual uploads by eliminating the need for manually input identity details into your own tools.

What’s in Trust?

Retrieve identity verification documents

such as PDFs of utility providers, telecom companies, and administrative services.

- Personal identity verification docs:

Retrieve identity verification documents directly from the source without having to rely on end users to upload those documents manually.

– Proof of residence with utility bills

– Proof of revenue through tax notices - Business identity verification docs:

Avoid fraud risk and fight against financial crime by automating the retrieval of identity verification documents directly from the source.

– Proof of company registration with SIREN, Kbis.

– Proof of financial statements with P&L, Tax declarations.

– Proof of ownership with Ultimate Beneficial Owner filings (UBO).

Capture identity data in a structured format—directly from the API

- Personal identity data

- Business identity data

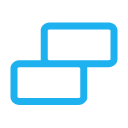

How users give access to their accounts to verify identity.

We ensure all user accounts are easy to connect and always available.

Webview link URL

https://walleto.biapi.pro/2.0/auth/webview/fr/connect/security?s=eyJjbGllb

1

Security & consent

We take your users by the hand by building trust and making sure they give their consent with confidence.

2

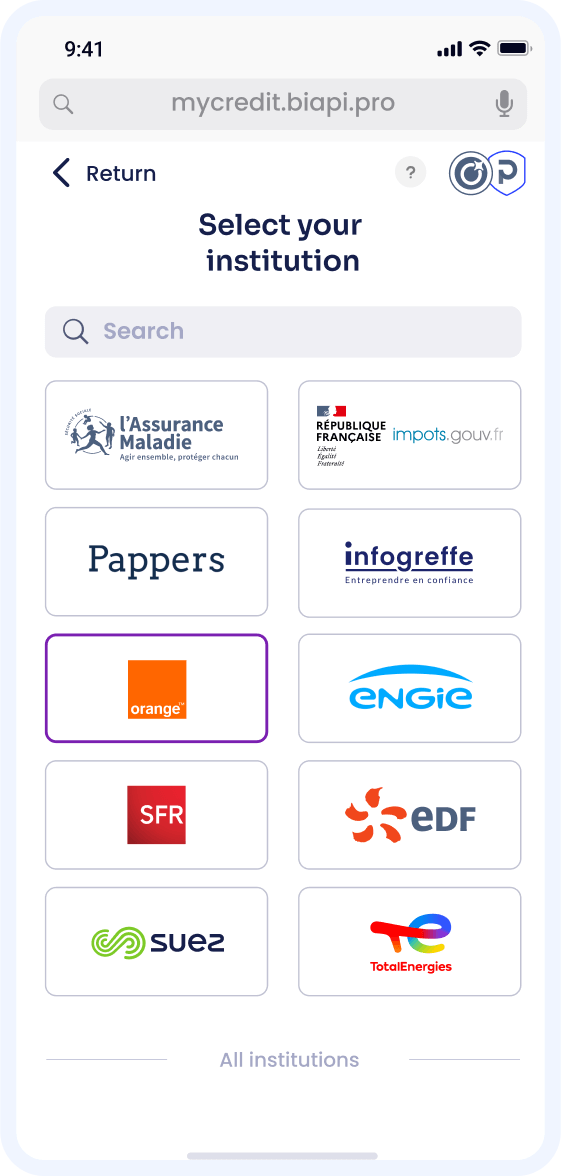

Administrative, Telco, and Energy provider selection

Users quickly find the right provider as we highlight popular ones and provide a blazing-fast search experience.

3

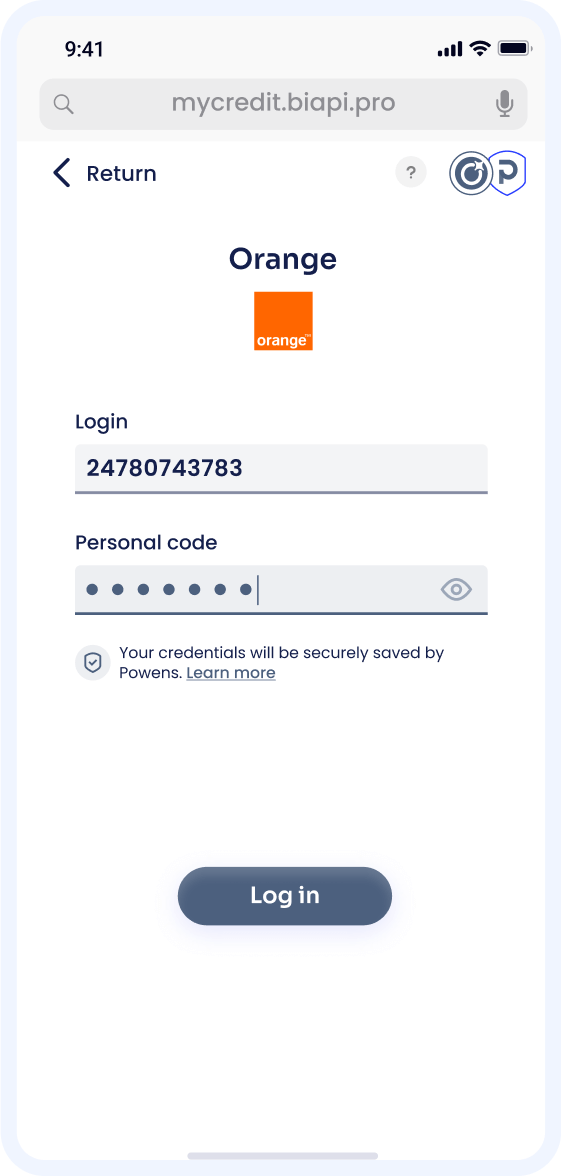

Authentication

Users can securely enter their login & password directly into Powens webview without the need for redirection.

4

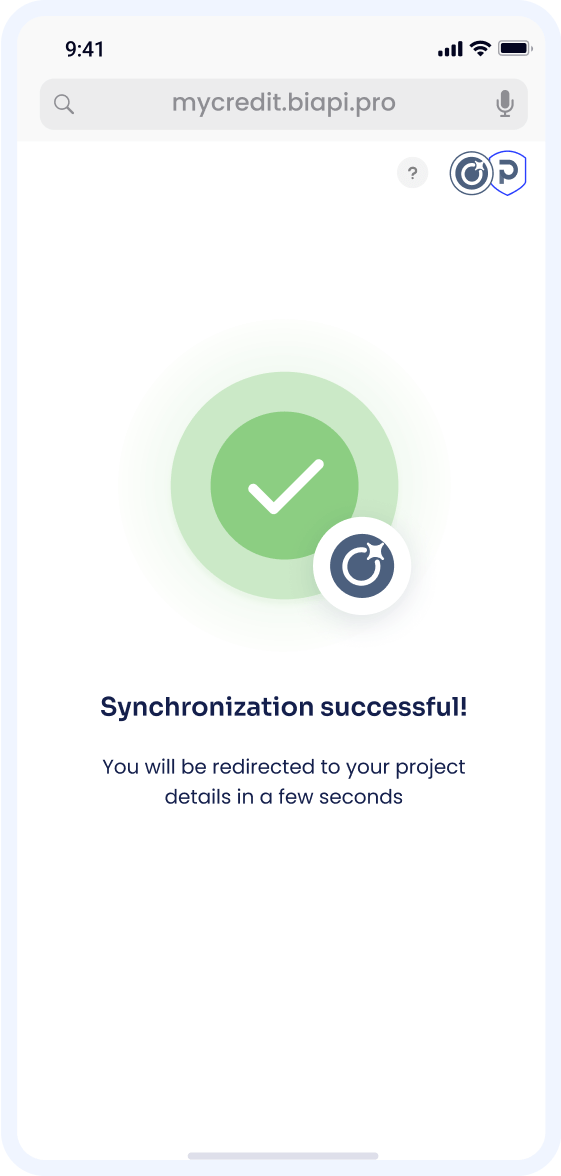

Synchronization

The user is redirected to your application or website. The document(s) confirming their identity, proof of residence, or revenue are compiled.

5

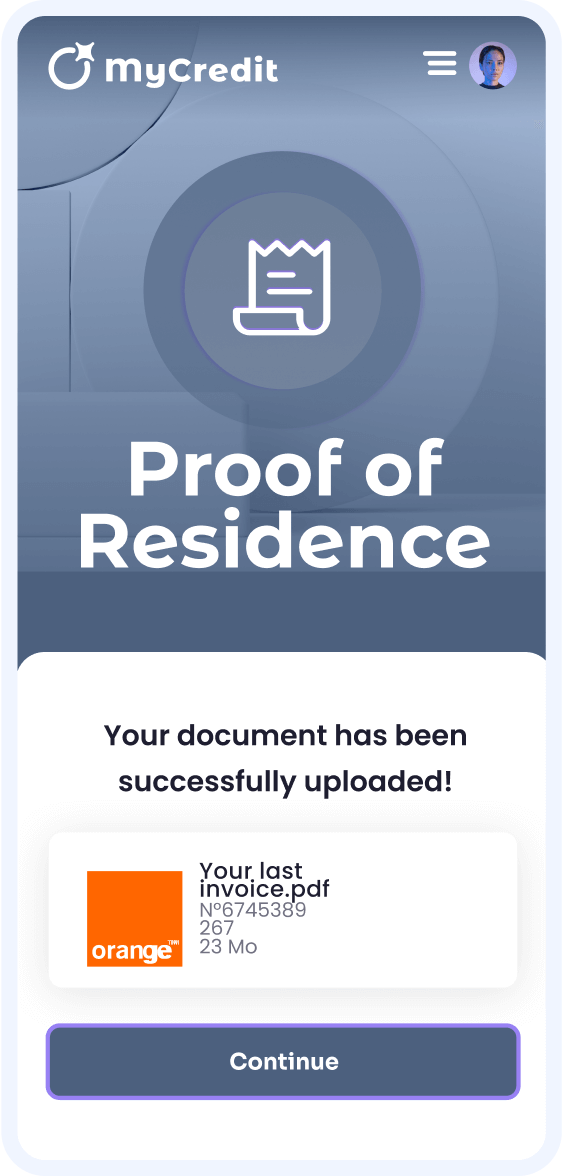

That’s it!

The document is transmitted, and the user can continue his onboarding journey within your application.

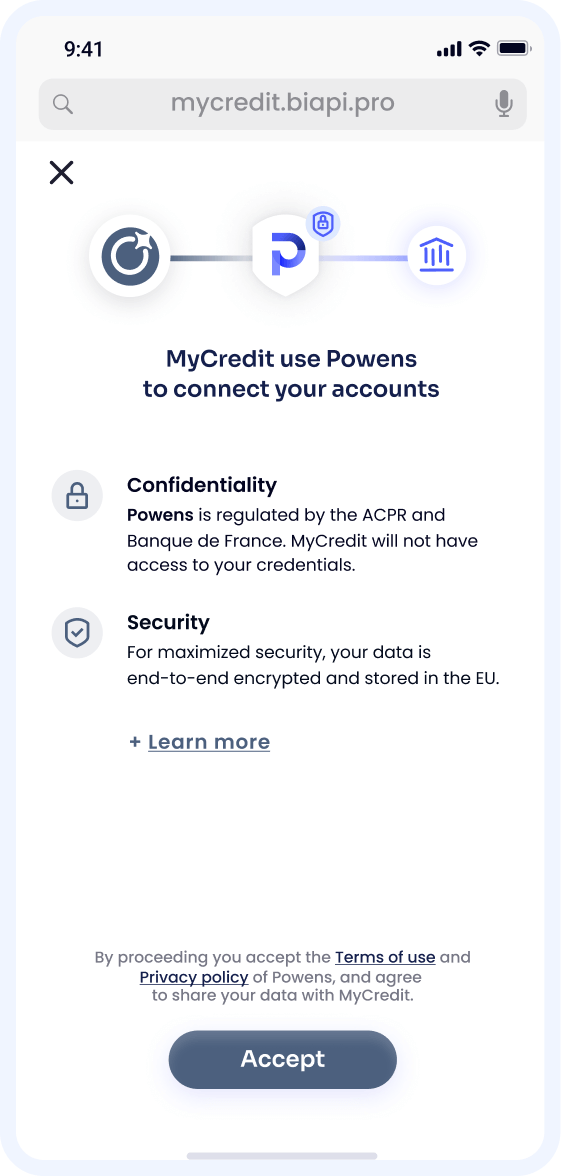

Powens Console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Set up a free sandbox in a few clicks and follow the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync use and keep an eye on health statuses.

Analyze

Visualize key metrics and trends to optimize your open finance experience (amounts, users, conversion rates...).

Powens by the numbers

2012

Expertise

260+

Clients

7M+

End-users

1.2B+

API Calls

1.3B+

Payments