- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Collection Solutions Tailored for Your Business Needs

Explore our versatile collection solutions tailored to meet your business requirements. From one-time collections to setting up subscriptions and recurring payments, our solutions optimize financial operations and facilitate your reconciliation.

Enhanced User Experience

Elevate customer satisfaction with a range of payment options including SEPA direct debit, bank transfers, and Open Banking payments among others.

Seamless Integration with Accounting Systems

Effortlessly integrate our solutions within your accounting and management systems for streamlined bank reconciliation, process automation, and enhanced operational efficiency.

Instant Access to Real-Time Data

Access real-time transaction data through our API integration, empowering you to make informed business decisions with accurate analysis.

Key Features

Gain access to one of the most comprehensive payin solutions portfolios, tailored for seamless collections within the SEPA zone.

- Comprehensive SEPA Payment Methods with Direct Debits and Credit TransfersExplore our comprehensive range of SEPA payment methods, including direct debits (Core and B2B) and credit transfers, tailored to diverse industries for both one-time and recurring transactions.

- Optimized Payment Experience with Open Banking SolutionsCollect payments directly from your website or app, offering a seamless experience similar to card payments. Eliminate intermediaries, ensure secure transactions, and prevent chargebacks.

Interested in learning more about our PAY product, our account to account payment capability (PSD2)

- Enhance your Collection Process with Card Payment Integration.Seamlessly integrate card payments into your collection process, enhancing customer convenience with a widely-used payment option. Please note that this service is exclusive to collections initiated from our IBAN accounts.

- Efficient Reconciliation Management with Unlimited IBAN IssuingUtilize our unlimited IBAN issuing capability to flag, track, and categorize your financial inflows. Easily reconcile incoming payments promptly and accurately.

How it works

Our Payin solutions are managed via API, which can be integrated within just a few days:

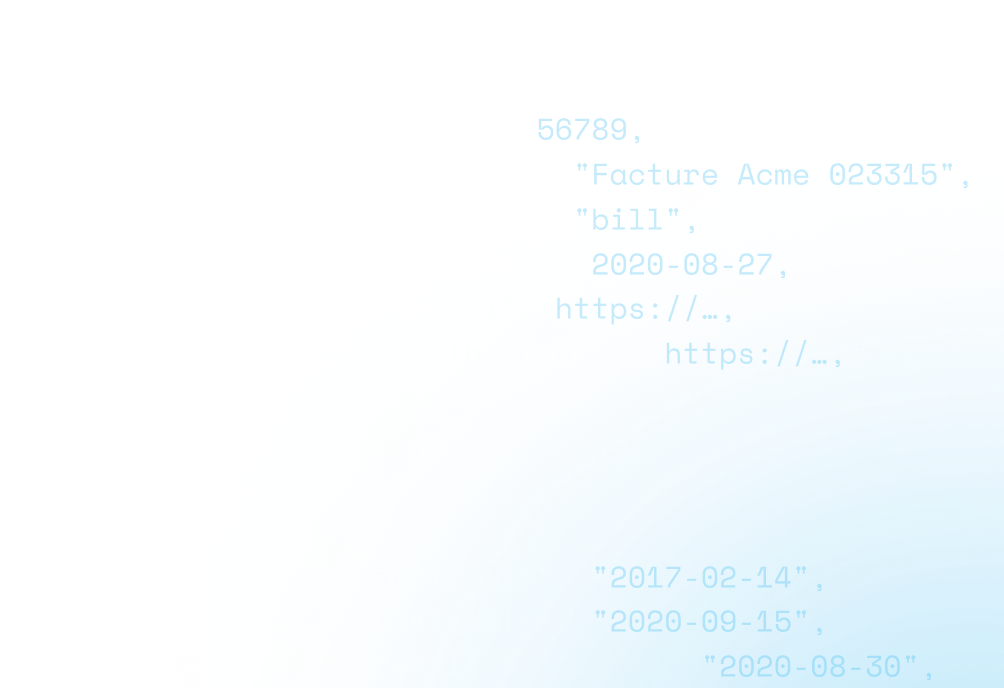

[

{

"wallet_id": "28cd89ed-3ee8-4d91-924b-ce9a31169e1c",

"name": "My First Wallet",

"balance": {

"currency": "EUR",

"amount": 10000

},

"outstanding_incoming_balance": {

"currency": "EUR",

"amount": 10000

},

"outstanding_outgoing_balance": {

"currency": "EUR",

"amount": 10000

},

"description": "Description of my first wallet",

"status": "ACTIVE"

}

]

1

IBAN Account Opening

Depending on the payin solution you wish to integrate, we will provide you with an IBAN account.

2

API Integration

Integrate our payment API with your backoffice (ERP, CRM, TMS, etc.).

3

Scheduling

Program your collection, define your rules and - in the case of direct debits - enter the mandate information before creating the collection order.

4

Real-time Notifications

Monitor in real time the status of your collections thanks to notifications of receipt of funds.

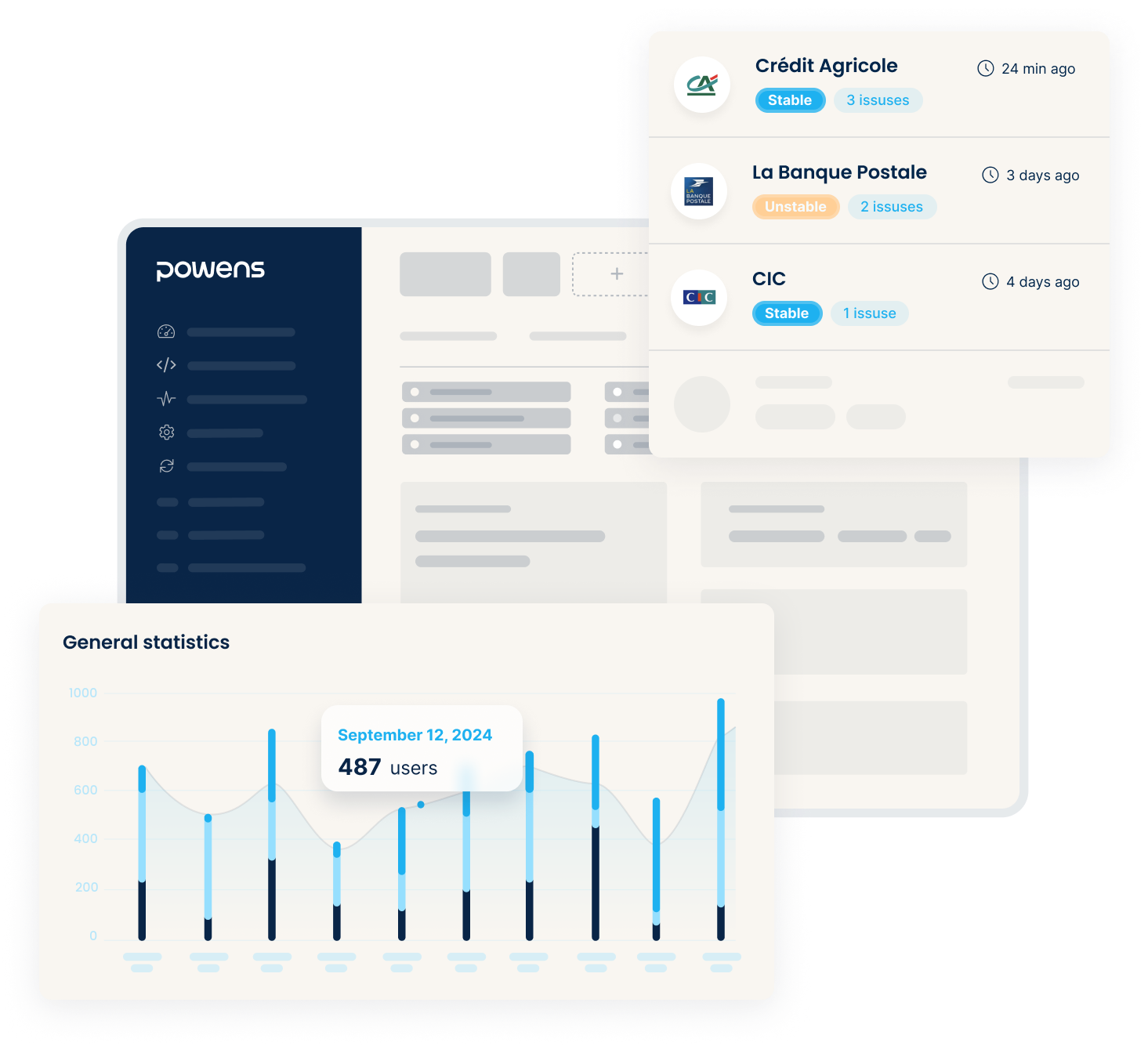

Powens’ console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Setup a free sandbox in just a few clicks and use the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync usage and keep an eye on health status reports.

Analyze

Visualize key metrics & trends to optimize your Open Finance experience (amounts, users, conversion rates...).

Powens by the numbers

2012

Expertise

260+

Clients

7M+

End-users

1.2B+

API Calls

1.3B+

Payments

IBAN and payment solutions are provided by Unnax Regulatory Services EDE, S.L. under its electronic money license (Bank of Spain registration code 6719).