- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Offer Account to Account

real-time payments to complement conventional payment methods.

Instant account-to-account payment to keep control of flows. Get paid easily by your customers, on a website, via a link or a QR code.

Real-time irrevocable payments

Real-time irrevocable payments offer instant processing, unlike the usual 24-48 hour SEPA delays. With an unchangeable finality, they ensure swift and reliable transfers in today’s rapid financial environment.

No beneficiary setup in the app

No more need to pre-create IBAN beneficiary in the bank app. Payment process is simplified for end users, eliminating the requirement to create and store beneficiary information for a standard SEPA transfer.

Get rid of card limits

Offer more flexible payment limits than traditional debit or credit cards. Your customers can make higher payments without being restricted by their card limits.

Automated bank reconciliation

With Payment Initiation Services, you get the unique advantage of customizing transaction labels. You can include specific payment references in the transaction label, automating the reconciliation process for unmatched efficiency.

Find out more about Pay features

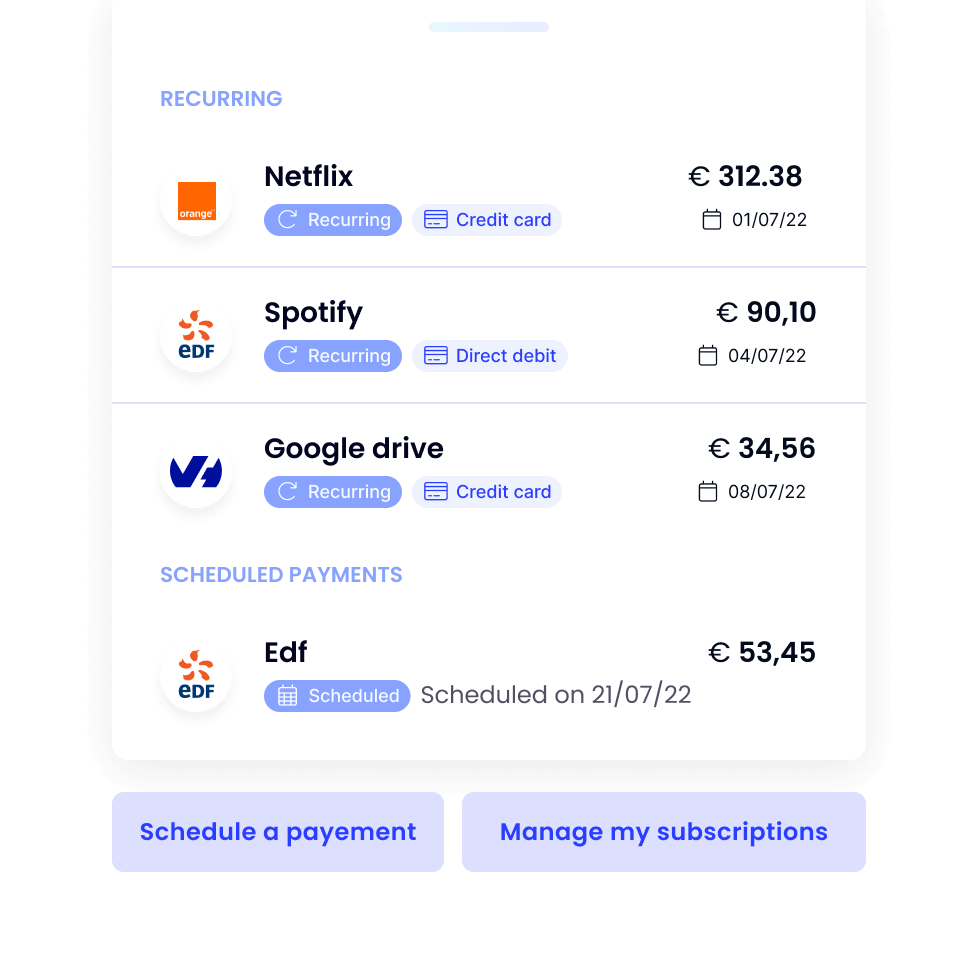

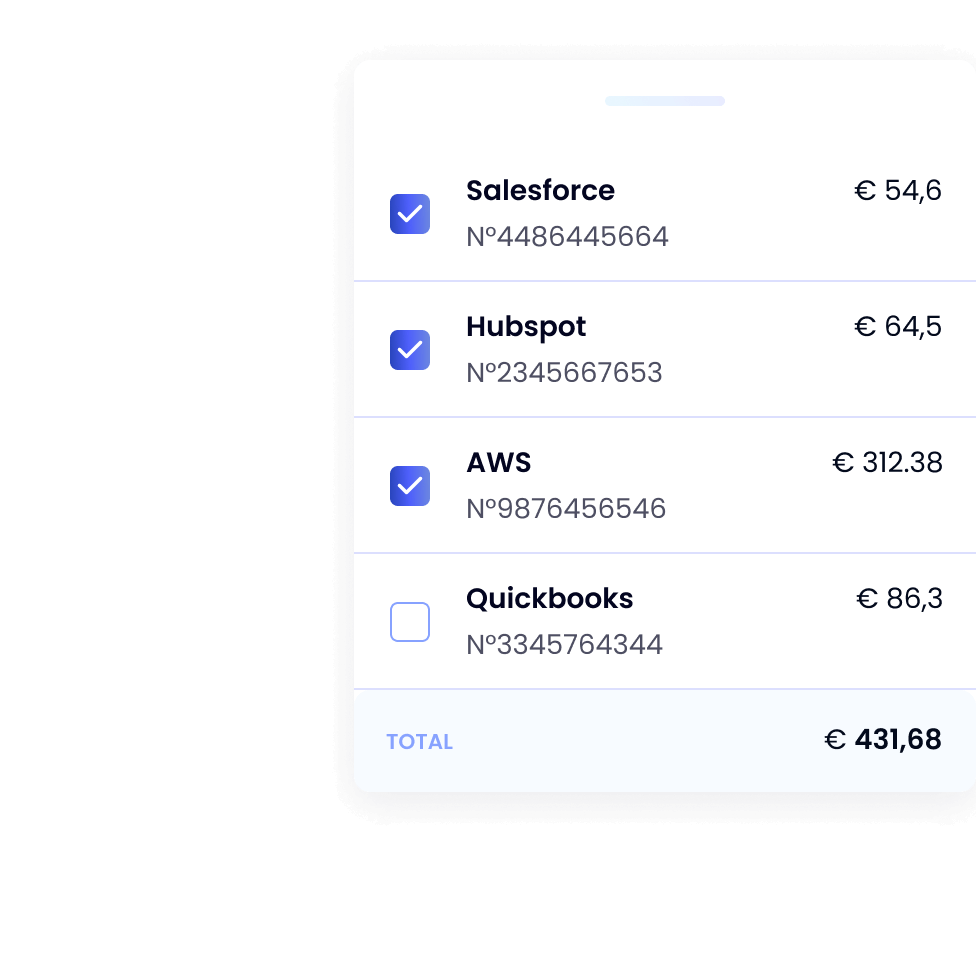

The best alternative to card and SDD for subscriptions & top-ups.

- Specify an amount, a frequency, and an end date,

and our API will generate a payment request instantly.

Trigger multiple payments to multiple beneficiaries in one go.

- Build a bulk payment in one API call.

- No need to set up beneficiaries.

- Only one payer validation is required for all payments.

- Up to 400 payments at a time.

How customers connect their accounts to your apps

POST /payments

{

"client_redirect_uri": "https://mycallback.com",

"client_state": "{optionalClientState}",

"instructions": [

{

"reference_id": "{myReference}",

"label": "Test",

"amount": 50.90,

"currency": "EUR",

"execution_date_type": "first_open_day",

"beneficiary": {

"scheme_name": "iban",

"identification": "FR76XXXXXXXXXXXXXXX",

"label": "ACME Corp.",

"merchant_scheme_name": "siren",

"merchant_identification": "012345678"

}

}

]

}

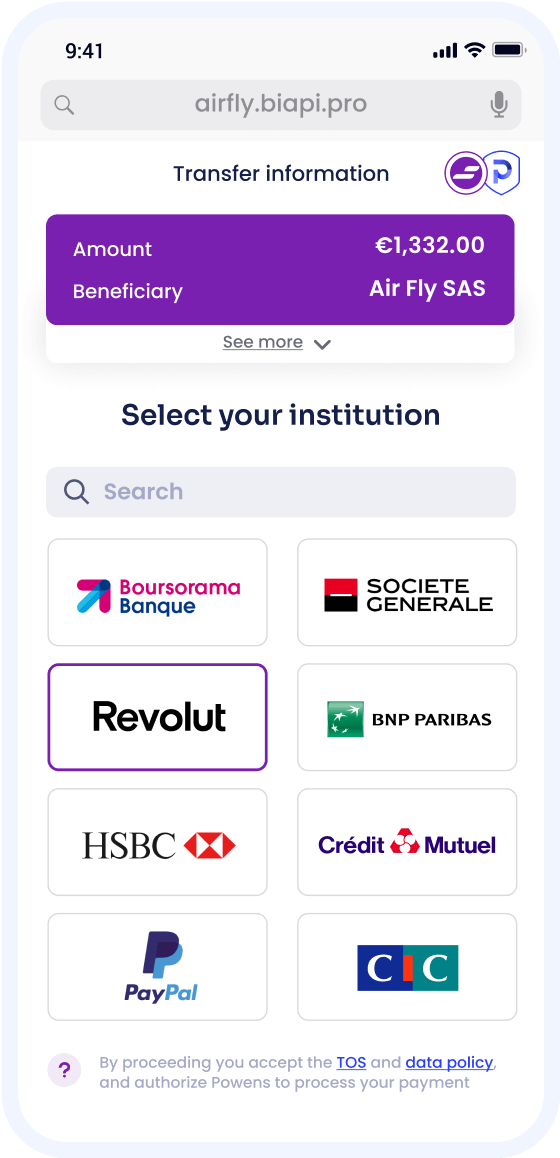

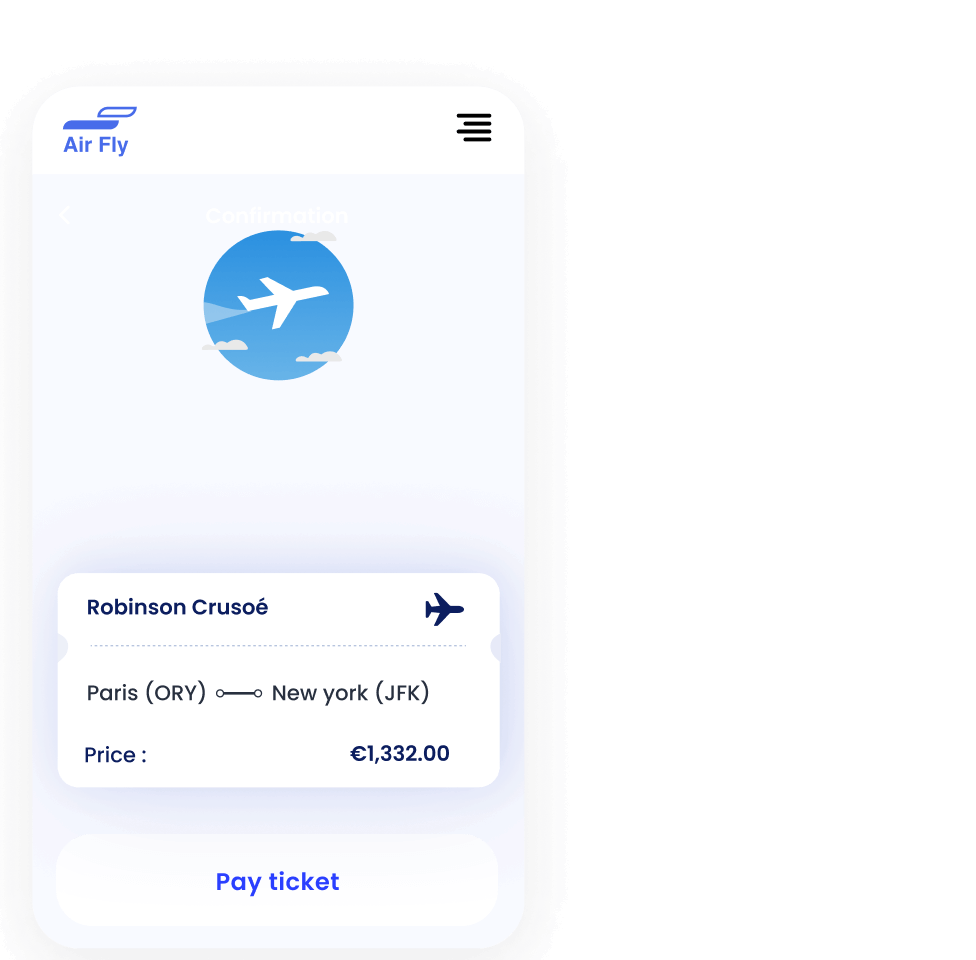

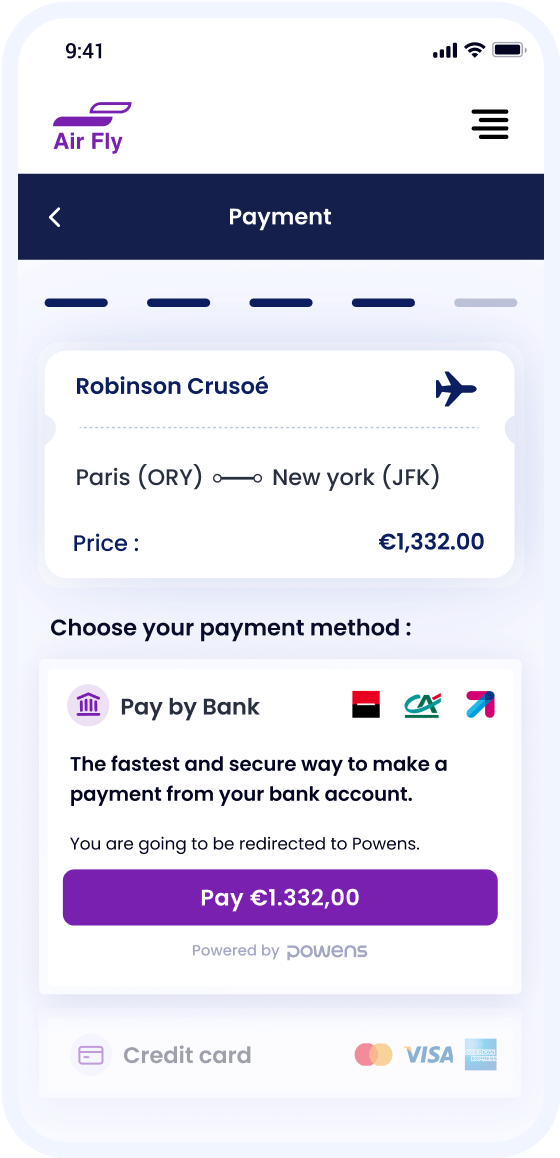

1

Build a payment link

Embed a “Pay by Bank” flow in your website or app and automatically generate a payment link with pre-filled transfer details (amount, IBAN...).

2

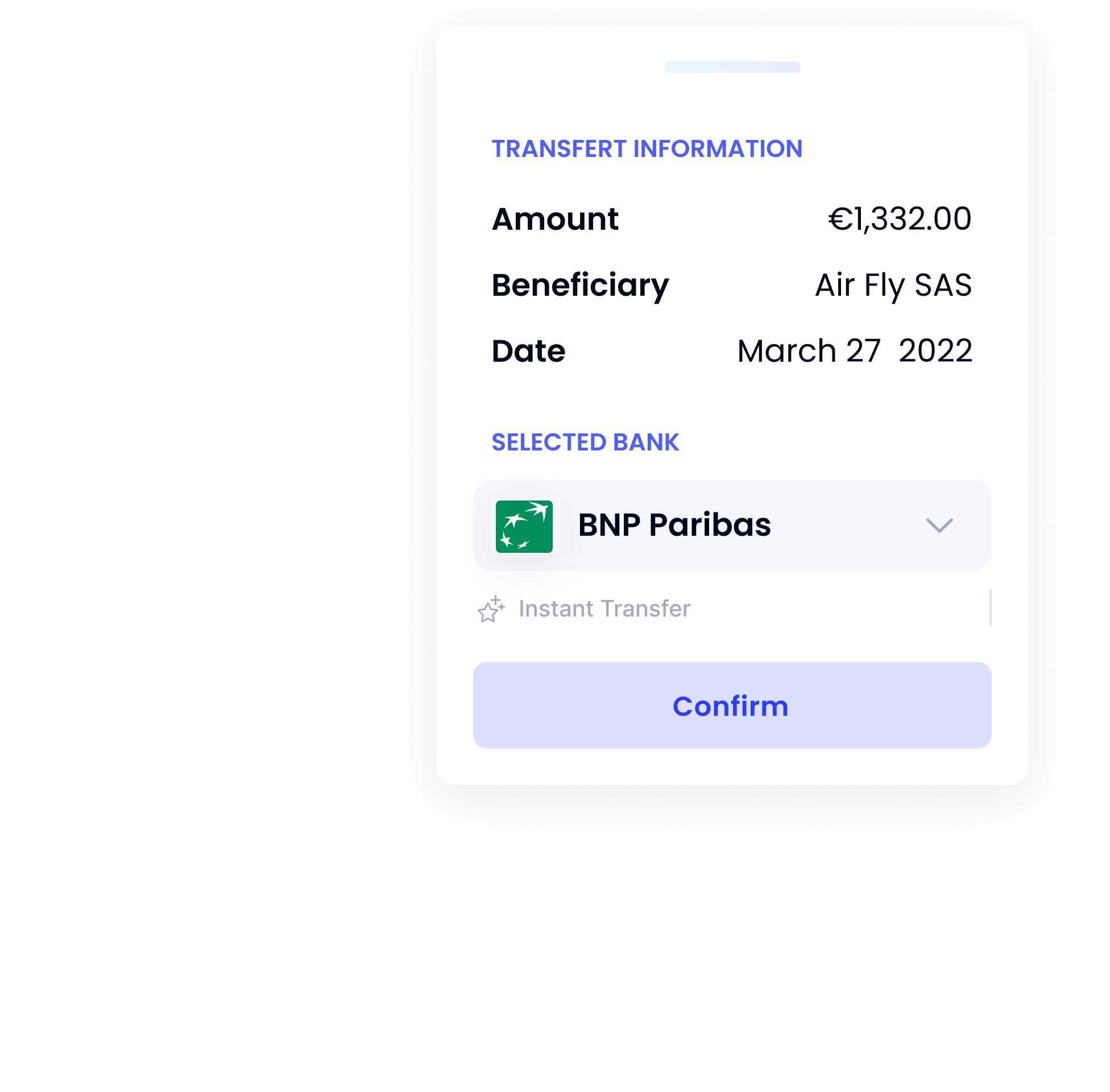

Payment details & bank selection

Users quickly find their bank : we highlight popular ones and provide a blazzing-fast search experience.

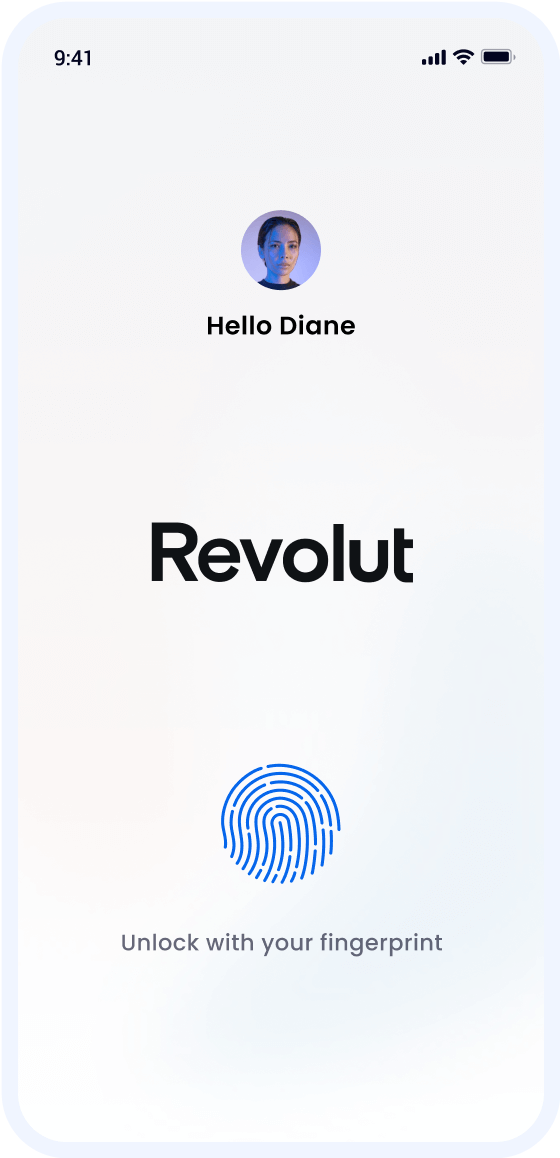

3

Authentication

The user is redirected to its bank’s mobile app or website to authenticate.

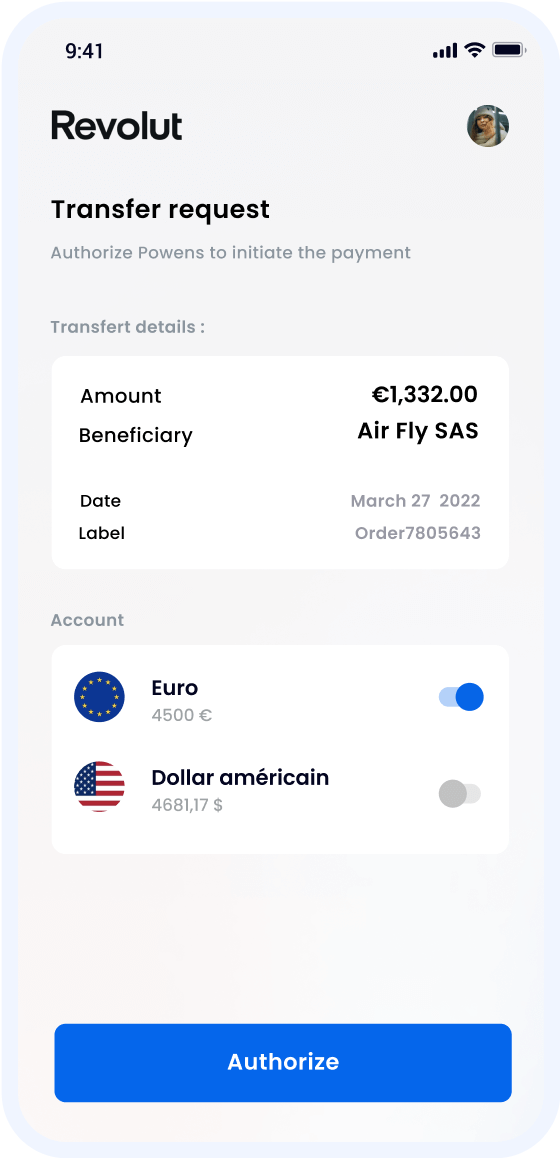

4

Payment validation

The bank displays a payment summary and the user validates with biometrics, shortcode or SMS code.

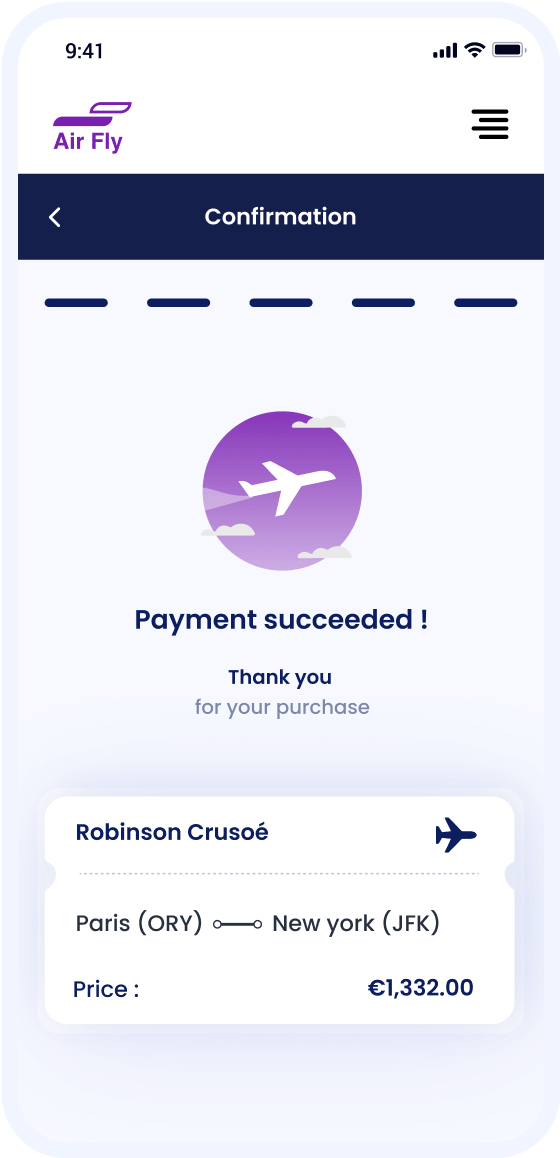

5

That’s it!

You receive a payment status instantly and redirect the user to your app or website.

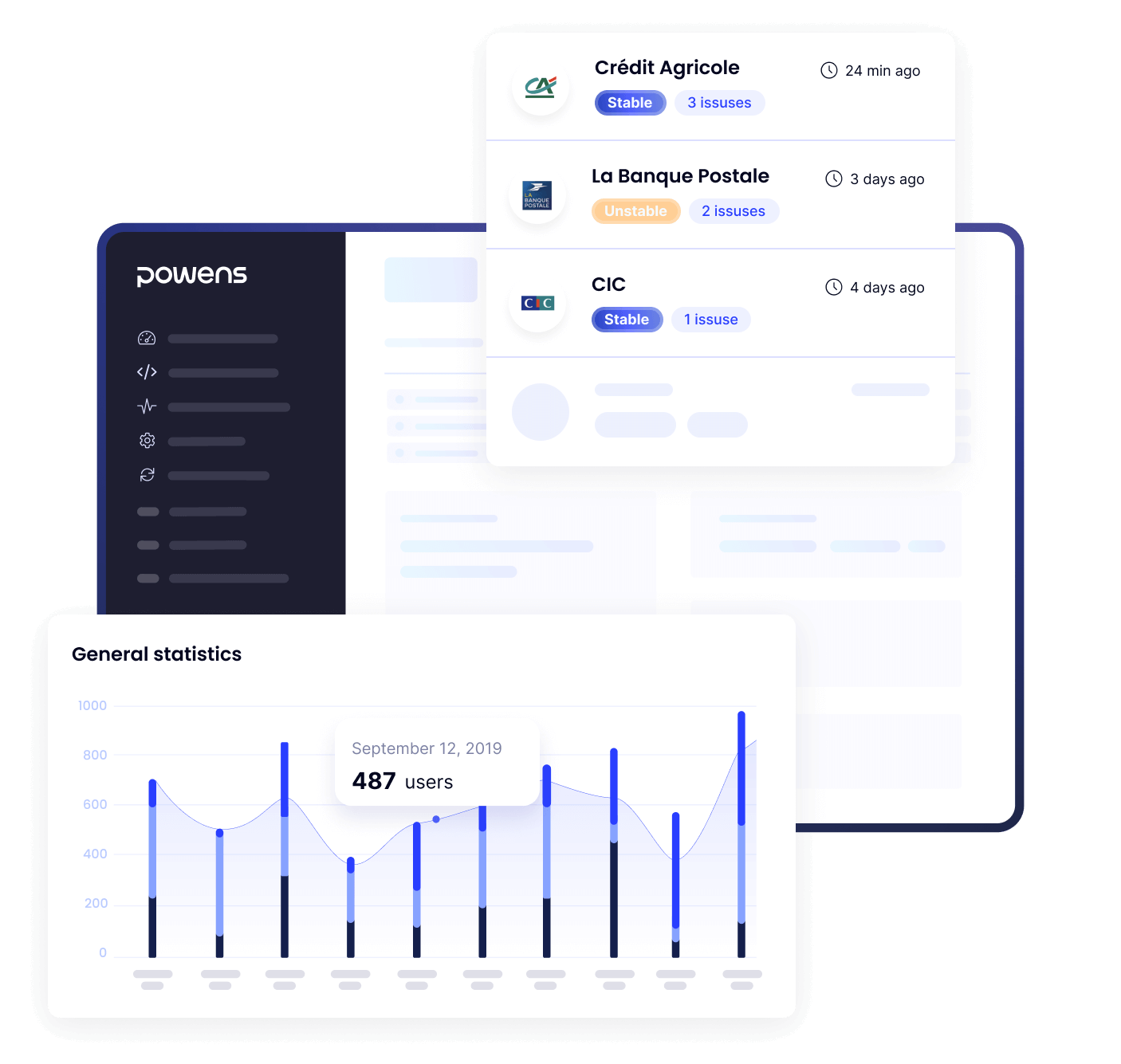

Powens Console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Setup a free sandbox in just a few clicks and use the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Track every payment with detailed status reports and error notifications.

Analyze

Analyze aggregated volumes, amounts and success rates.

Why Powens?

2012

Expertise

260+

Clients

7M+

End-users

1.2B+

API Calls

1.3B+

Payments