- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Building the future of Financial Services

When we founded Powens, we set out on a journey to reinvent banking. Along the way, we realized we also wanted to give users control over their data and take financial services to new places. Originally built as an Open Finance platform, we realized that, to achieve this mandate, we needed much more than just data aggregation. That’s why we become today the only platform that brings together Open Finance and Embedded Banking. We empower financial institutions, fintechs, and software vendors across Europe and LATAM to create innovative products and streamline their financial operations through frictionless and fully automated banking and payment experiences. With Powens, possibilities become limitless. Join us in shaping the future of finance.

We are a united team around four values

Bold

We take initiative and are not afraid to blaze a new trail.

Committed

We are dedicated to conquering any problem.

Teamwork

Individuals are at the service of the group.

Striving for the best

Our humility pushes us to become better and better.

Our mission

At Powens, we’re committed to empowering financial players to build better banking and payment experiences. We strive to build Europe’s number one platform combining Open Finance & Embedded Banking, so banks and fintech can innovate at light speed.

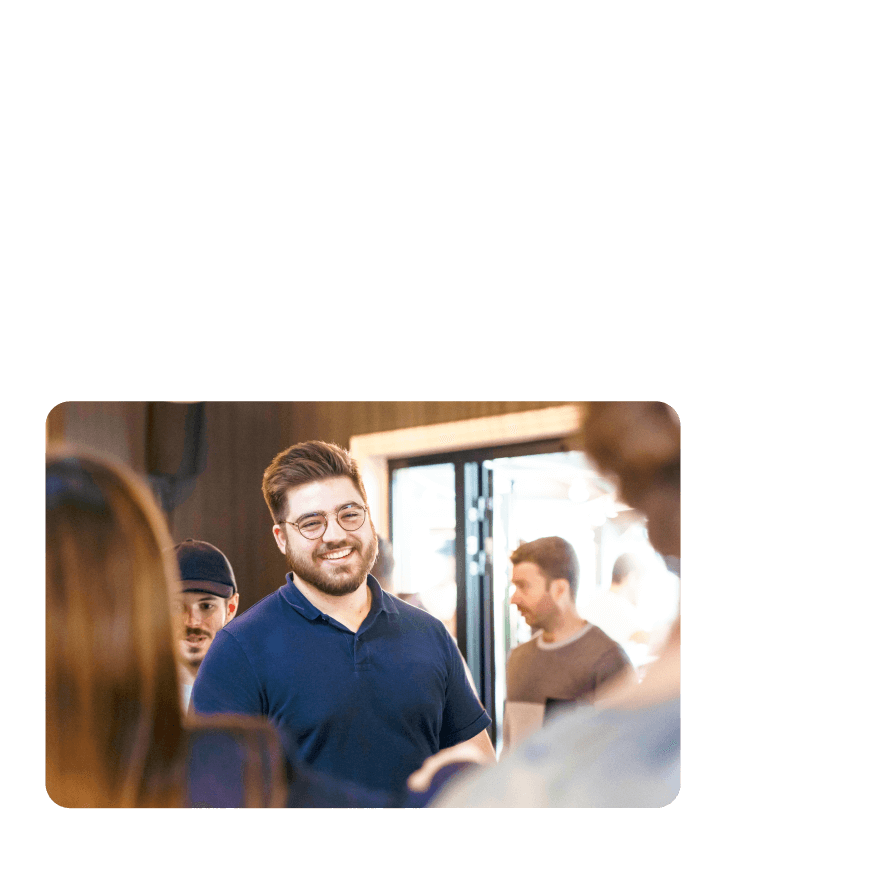

Meet our CEO

Jean Guillaume

CEO

The Management Team

Guillaume Lhoste

Chief Financial Officer

Nicolas Ribeaut

Chief Commercial Officer

Bertrand Tillay Doledec

Chief Product Officer

Eric Raduan

Chief Operations Officer

Estefanía Ramos

Chief Compliance Officer

Benoît Fillon

Chief Technology Officer

Gwendoline Savoy

Chief Marketing Officer

Justine Michel

Chief Human Resources Officer

Let’s look at our history

11+ Years of expertise

Let’s look at our history

2024

Powens expands its offering by combining Open Finance and Embedded Banking following acquisition of Spanish EMI Unnax

01

/ 12

Let’s look at our history

2023

Powens in France and Unnax in Spain, two of Europe’s most prominent Open Finance fintech leaders, announce their official agreement to join forces and create a European Open Finance champion.

The transaction is subject to the authorization of Spain’s national competent authority (Banco de España).

02

/ 12

Let’s look at our history

2022

Budget Insight raises $35 million from PSG Equity. This new investor should allow the company to develop new products and significantly increase its European footprint, strengthening its position as a leader in Open Finance.

On October 25, Budget Insight has become Powens.

03

/ 12

Let’s look at our history

2021

In 2021, Clément was leaving for new adventures. With his new role as President, Romain will direct the strategic choices related to technology and innovation.

He will now lead the company alongside Bertrand, the appointed CEO. His role is to define the company’s objectives and strategic orientations.

04

/ 12

Let’s look at our history

2019

Budget Insight joins the Crédit Mutuel Arkéa group to accelerate its development and expand in Europe. A partner of choice that shares its vision of banking and its founding values: customer satisfaction and employee happiness.

05

/ 12

Let’s look at our history

2018

The PSD2 comes into effect intending to regulate the activity of AIS (Account Information Services) and PIS (Payment Initiation Services) providers. Budget Insight becomes a payment player approved by the ACPR (Autorité de Contrôle Prudentiel et de Résolution). The company’s business thus enters a regulatory framework.

06

/ 12

Let’s look at our history

2016

With several banking groups among its clients, European expansion was now an obvious choice. The Luxembourg subsidiary is created.

07

/ 12

Let’s look at our history

2015

The company is growing. To support the growth of the teams, it has moved from offices in incubators to its own premises on rue Beaubourg, in the heart of Paris.

08

/ 12

Let’s look at our history

2014

Budget Insight just won its first major contract with Swiss Life, which is willing to provide users with a 360° view of their financial assets. So this is how the Wealth API offering was born.

09

/ 12

Let’s look at our history

2013

The application designed to make people’s life easier was struggling to convince investors. A new business model then took shape: Budget Insight turned into a B2B company for the benefit of transforming financial uses, making it the pioneer of Open Finance.

This change paid off. Companies need banking connectivity now more than ever!

10

/ 12

Let’s look at our history

2012

In January, Clément Coeurdeuil, an engineer at Centrale Supelec school, reached Romain Bignon. His idea is to suggest Romain create a company together to develop a PFM* mobile app by exploiting woob.

On February 27, Budget Insight’s articles of association were filed! The app was then born in a small office within Centrale’s premises.

*Personal Finance Manager, an automatic bank account management app for individuals.

11

/ 12

Let’s look at our history

2010

In February, Romain Bignon, a self-taught developer, created Woob. This open-source connector library automates interactions with video, news, job search, and banking websites. Fun fact: the first connector was developed for… a dating website!

12

/ 12

Stay Ahead with Insights on Open Finance and Embedded Banking

Read our news