- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Automated Bank identity verifications

Account Check by Powens supercharges customer onboarding and payment experience with API-based verification of bank account ownership.

Adopt a seamless user experience

Create a frictionless experience with an automated IBAN verification that eliminates manual user declarations through simple user authentication from his or her banking institution.

Automate process

Automating the IBAN verification process will increase operational efficiency and save time and money. With just one click, your users can enjoy instant and accurate verification of their IBAN, no more need to search it or laboriously type multiple characters.

Fight against bank identity theft

Drastically reduce the risk of fraud by verifying the accuracy of IBANs and retrieving ownership with PSD2 data directly from banks.

What’s in Account Check?

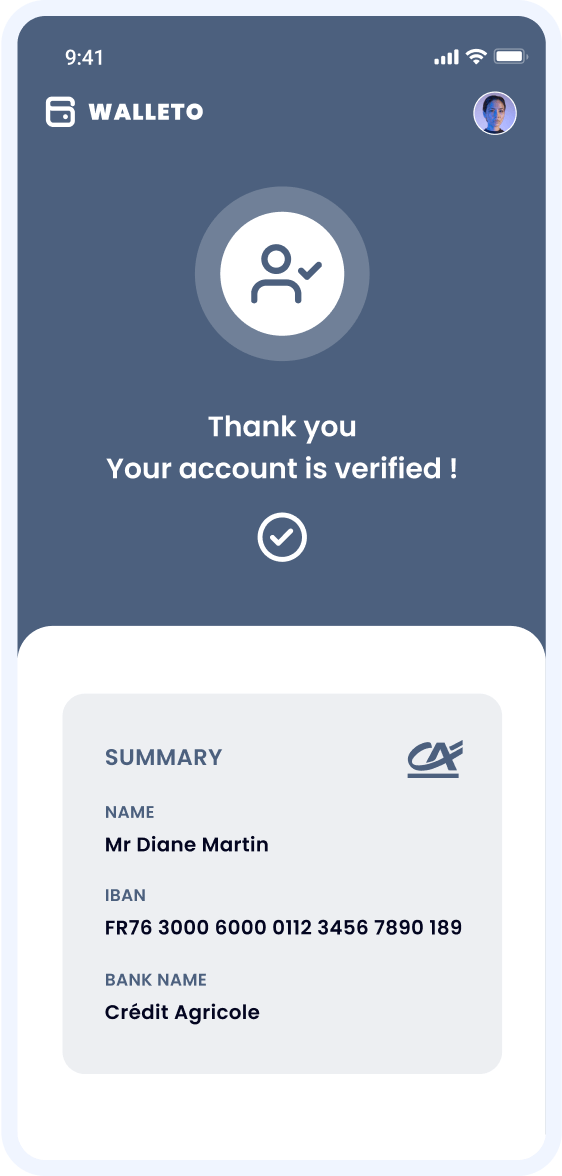

Retrieve bank ownership data in a few seconds.

- The type of the account (Personal or Business)

- The label of the account

- The account scheme name (IBAN, BBAN, Sort Code account number, etc.)

- The identification number of the account

- For individual accounts:

– The full account holder’s name

– Two names might be noted here in case of a shared account

– The role of the user granting account access - For professional accounts:

– The corporate name

How Open Banking automates account verification in 5 simple steps.

We ensure all user accounts are easy to connect and always available.

Webview link URL

https://walleto.biapi.pro/2.0/auth/webview/fr/connect/security?s=eyJjbGllb

1

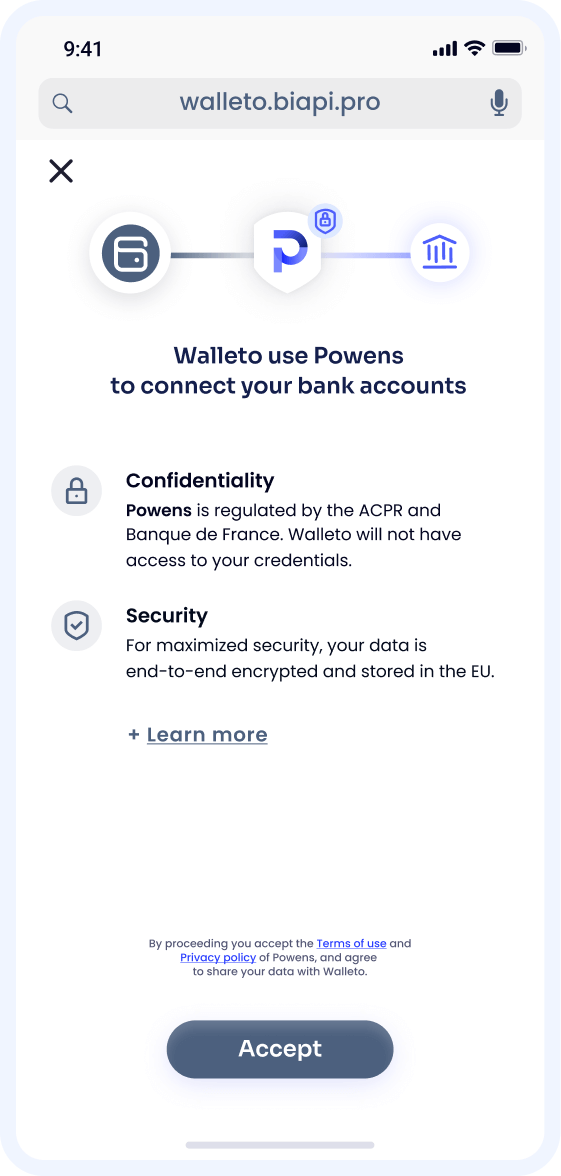

Security & consent

We take your users by the hand by building trust and making sure they give their consent with confidence.

2

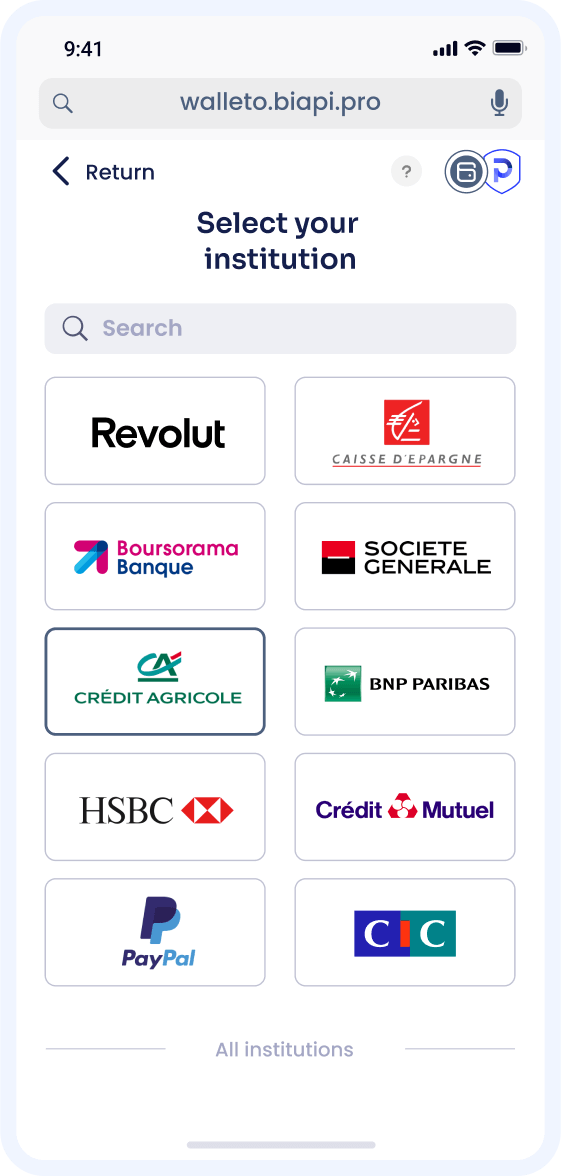

Bank selection

Users quickly find their bank: we highlight popular ones and provide a blazing-fast search experience.

3

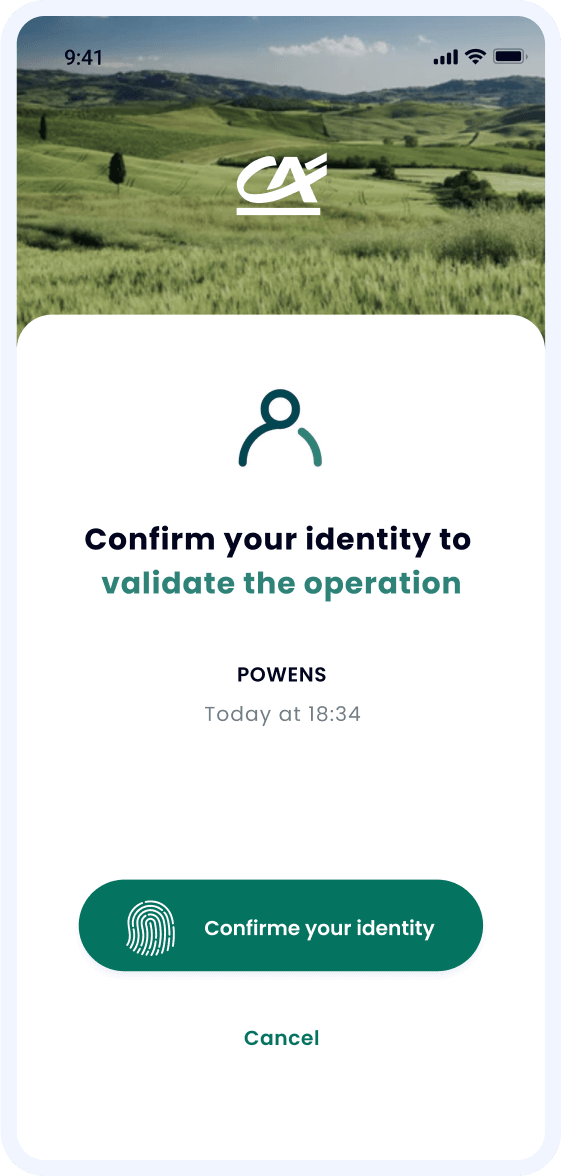

Authentication

App-to-app, web redirection, embedded: our API makes it easy to fine-tune the perfect authentication flow for each use case.

4

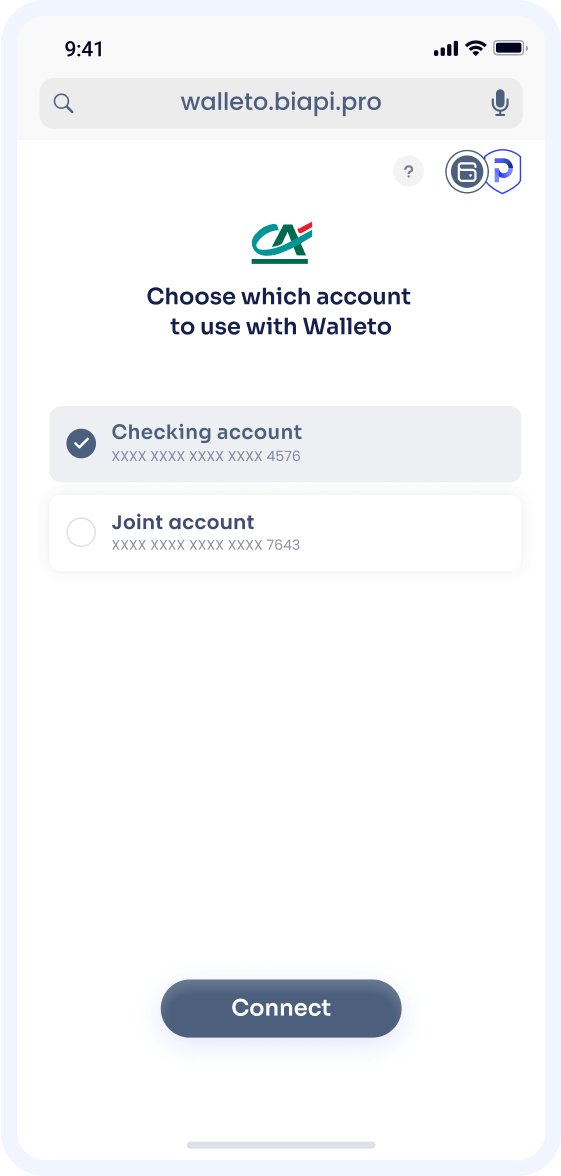

Account selection

Users can select the bank accounts they want to share, making our consent flow fully GDPR-compliant.

5

That’s it!

After the user validates through the bank’s mobile app or SMS code, the user’s identity and IBAN are instantly retrieved.

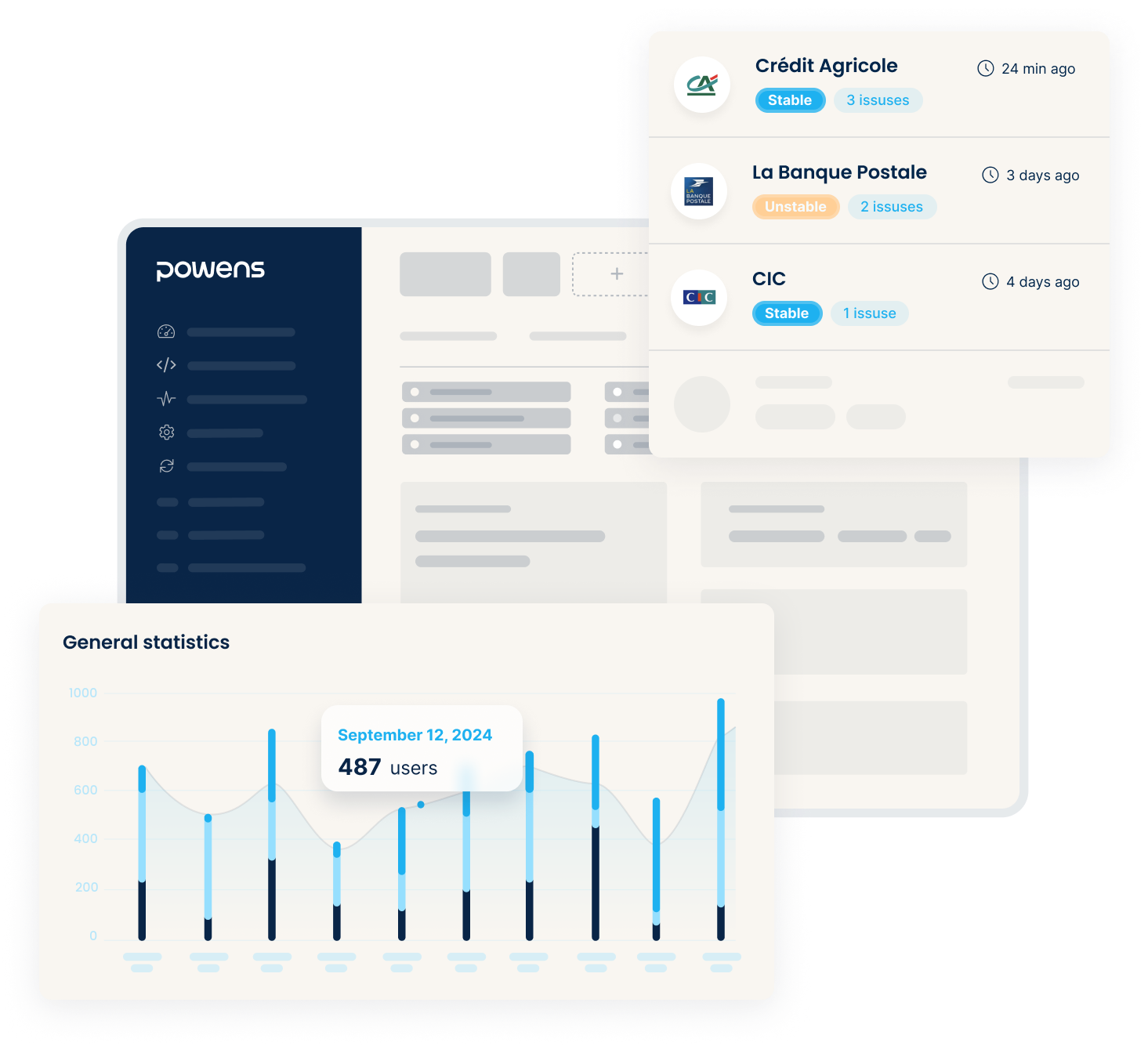

Powens Console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statuses.

Create an account and let us guide you

Setup a free sandbox in just a few clicks and use the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync use and keep an eye on health statuses.

Analyze

Visualize key metrics & trends to optimize your Open Finance experience (amounts , users, conversion rates...).

Powens by the numbers

2012

Expertise

260+

Clients

7M+

End-users

1.2B+

API Calls

1.3B+

Payments