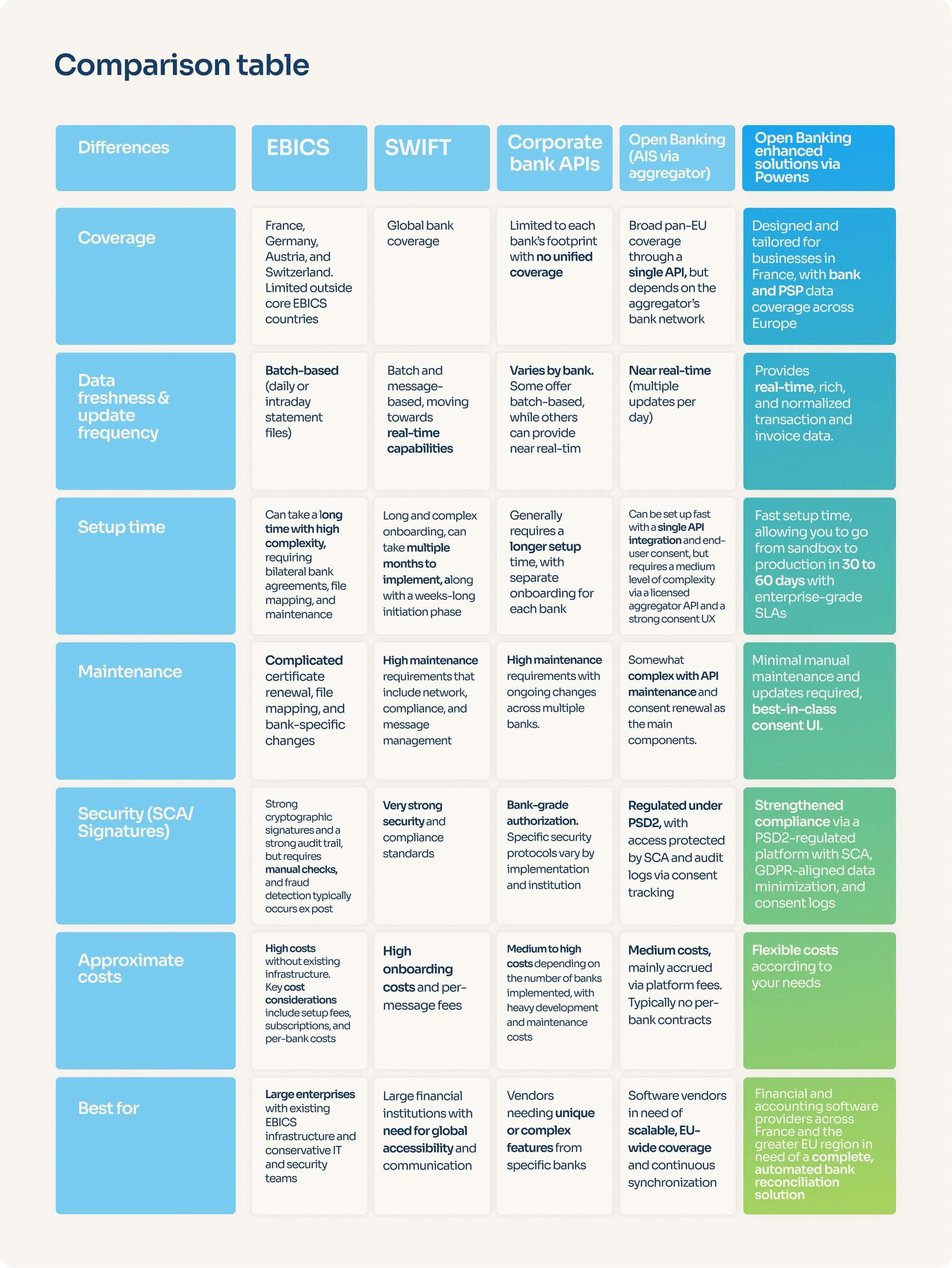

At a glance:

- EBICS: Widely used protocol in France/Germany, but batch-based, maintenance-heavy, and slower to scale across multiple banks.

- Open Banking/AIS: Near real-time data, EU-wide bank coverage via a single API, with consent renewals every ~180 days.

- Enhanced AIS: In France, financial and accounting software vendors often combine AIS with PSP attachments and Virtual IBANs for full auto-matching.

- Powens’ solution for accounting, invoicing & cash management: Complements or replaces EBICS, offering pan-EU bank coverage, PSP enrichment, PIS/SDD, and Virtual IBANs for faster, automated reconciliation.

Financial and accounting software vendors in France face trade-offs when connecting to banks for automated reconciliation. While EBICS remains a popular choice for batch payments among large enterprises, modern alternatives like Open Banking, provided by companies such as Powens, offer broader, automated, and more scalable solutions.

EBICS alternative in France: What product leaders should use (and when)

EBICS has a long history in France’s corporate banking infrastructure. Its reliable, secure corporate-grade protocol provides large enterprises with the foundational capability to exchange payment files and account statements. Though EBICS remains a popular choice among these enterprises for batch payments and standardized bank connectivity, financial and software vendors are starting to look elsewhere.

That’s because building automated reconciliation with comprehensive coverage at scale requires a solution that goes beyond the limitations of EBICS. Financial and software vendors need a high degree of data freshness, optimized for coverage across many banks and frequent data refreshes. On top of this, vendors need the ability to quickly onboard thousands of end users.

Unfortunately, EBICS can create operational bottlenecks due to its high level of complexity, especially if a vendor lacks an existing EBICS infrastructure with the majority of banks.

Automated reconciliation depends on fresh transaction data, consistent formats, and the ability to roll out connectivity broadly without multiplying your maintenance effort. French vendors must evaluate a wide range of factors when selecting a solution that includes everything from security and time-to-market to scalability across Europe and the internal resources needed to maintain connectivity over time.

Luckily, several EBICS alternatives exist today that can reduce a vendor’s operational complexity while still delivering the EU coverage and data freshness necessary to automate reconciliation effectively.

The 4 main ways to connect to banks

1. Host-to-Host (SFTP)

Host-to-Host connections rely on direct file exchanges between a company and each individual bank.

This model is dependable and well-suited to batch-oriented use cases such as end-of-day statements or bulk payment files. However, for SaaS and ERP vendors, it comes with significant drawbacks, like hefty per-bank setups, custom file formats, long onboarding cycles, and complicated ongoing maintenance needs as banks change specifications. Scaling reconciliation across hundreds or thousands of customers quickly becomes a tremendous operational expense via this method.

2. EBICS (Electronic Banking Internet Communication Standard)

EBICS standardizes Host-to-Host connectivity across France and the DACH countries Germany, Switzerland, and Austria.

It offers strong authentication, multi-signature workflows, and a shared protocol, making it a solid choice for corporate-grade batch exchanges. That said, EBICS remains batch-based, requires certificate management, and still involves bank-by-bank activation. Its regional focus also limits its usefulness for vendors targeting broader European coverage.

3. SWIFT

SWIFT provides global bank reach and highly reliable financial messaging.

The tradeoff is its complexity. SWIFT onboarding is heavy, per-message fees can quickly stack up costs, and the integration effort required is substantial. For many accounting and reconciliation use cases, and especially for SMEs, the costs of SWIFT are often excessive relative to the value delivered.

4. APIs (Corporate APIs & Open Banking/AIS)

Bank APIs can provide real-time or near-real-time data access.

Corporate APIs can be powerful, but remain fragmented bank by bank. Open Banking/AIS under PSD2 addresses this by offering standardized access through aggregators, delivering broad coverage via a single API. The main tradeoff is consent management, typically requiring renewal every ~180 days. However, for data freshness and scalability, APIs are increasingly the preferred solution.

EBICS vs. Open Banking (AIS) for automated bank reconciliation in France

For automated reconciliation, the most visible difference between EBICS and Open Banking AIS is data freshness. EBICS transaction data arrives afterwards because the solution operates on scheduled batch exchanges, typically daily but sometimes intraday. AIS, by contrast, enables near real-time access to account data, with multiple automatic refreshes per day. For accounting platforms aiming to reconcile transactions as they happen, this freshness materially improves matching rates and user experience.

Set up and ongoing operations also differ significantly between the two:

- EBICS requires formal, bilateral EBICS agreements with each bank, certificate and signature management, and mapping of files per institution. These steps translate into longer lead times and recurring operational work. Vendors must also account for EBICS fees and EBICS subscriptions, which vary by bank and can scale with volume.

- AIS shifts this effort toward a single aggregator API and a well-designed consent flow, reducing integration complexity and accelerating rollout across banks.

From a compliance and audit perspective, EBICS relies on cryptographic signatures and non-repudiation. Meanwhile, AIS operates under PSD2 with Strong Customer Authentication (SCA) – a security measure that requires users to verify their identity by sharing at least two of three factors: something they know, own, or are – and detailed consent logs. These logs provide a clear audit trail, though vendors must plan for the practical reality of consent renewal roughly every 180 days.

EBICS remains a strong option for EBICS bank connectivity within France and German-speaking regions. AIS, however, supports pan-European coverage from day one, making it especially attractive for software vendors serving clients across multiple EU markets.

Architecture blueprint for software providers (how to build this right)

The first step in rolling out automated bank reconciliation is setting up the right connectors to access all relevant financial data. These typically fall into four groups:

- Open Banking connectivity (AIS) for bank accounts

- Payment provider connectivity for PSP wallets

- Invoicing connectivity for supplier invoice portals

- Embedded, tracked payment connectivity (PIS, SDD, Virtual IBANs) to reconcile initiated payments end-to-end.

Most financial software providers follow a maturity path starting with AIS for fast coverage, then layering in PSPs, invoices, and embedded payments to steadily increase auto-matching rates. With ready-made connectors, sandbox-to-production can take a few weeks, while a full-stack setup usually lands within 30 to 60 days. The architecture depends on solid data modeling and an exception rules engine that automates standard matching and routes only true outliers into queues for review, with monitoring dashboards tracking mismatch rates and cycle times. A key pitfall to consider is poor consent UX. If consent flows are unclear, branded, and SCA-aware, data access breaks down, and automation can quickly degrade.

Real-world outcomes

Qonto

Qonto, a provider of bank accounts for entrepreneurs and businesses, used Powens’ Open Banking platform to achieve pan-EU aggregation and an exceptional UX, with an NPS greater than 75.

Read Qonto’s success story here

Agicap

Agicap, an online cash management software provider, worked with Powens to achieve real-time cash tracking for more than 6,000 customers across 11 countries.

Discover Agicap’s case study here

Pennylane

Pennylane, a full-stack financial management platform, implemented Powens solutions to sync 120,000 SME accounts with daily data refreshes, achieving twice the stability of other Open Banking providers.

Further reading: The Importance of Real-Time Cash Flow Visibility for Accounting Software

When EBICS is still the right choice – and when a hybrid makes sense

EBICS remains suitable in France and the DACH region for large treasury batching at large corporates, as well as for use cases where banks mandate EBICS for batch payments and statement exchanges. Its proven security and standardized, reliable protocols maintain its importance for handling high-value financial workflows that are not dependent on same-day or intraday updates.

However, for accounting and financial software vendors looking to automate reconciliation or deliver real-time analytics within the EU, adopting a hybrid approach with AIS for analytics and reconciliation freshness is the more ideal solution. Pairing EBICS with Open Banking/AIS connectivity allows companies to retain the comprehensive batch processing capabilities of EBICS while also benefiting from near real-time transaction updates across multiple banks. This combination delivers both operational stability and the freshness, scale, and automation efficiency modern platforms require.

How Powens complements or replaces EBICS for reconciliation

Powens offers financial and accounting software providers a modern alternative to replace or complement EBICS.

Combining broad AIS coverage across France and the EU with enriched PSP and neobank attachments, Virtual IBANs, and automated payment matching capabilities, Powens enables reconciliation at the source, resulting in reduced manual processes and increased accounting accuracy.

Our consent UX is optimized for high acceptance, achieving a 75% benchmark, and backed by enterprise-grade SLAs that help ensure reliable scalability.

With standardized feeds, PSP enrichment, and a fast rollout, Powens delivers a scalable, pan-European Open Finance platform. Our solutions are trusted by clients like Qonto and Agicap, reconciling over 100 million transactions per month while providing actionable, automated reconciliation across multiple banks.

IBAN and payment solutions are provided by Unnax Regulatory Services EDE, S.L. under its electronic money license (Bank of Spain registration code 6719).

Ready to combine connectivity with embedded payments?

Feb 03, 2026

Feb 03, 2026