Though once dominated by monolithic systems accessible only to companies with substantial IT budgets, accounting management software now comprises a broad selection of SaaS tools for businesses of all sizes.

Advancements in financial technologies, such as API integrations, Open Banking protocols, and data aggregation tools, have paved the way for end-to-end automation of specific processes like bank reconciliation, compliance reporting, and cash flow tracking. These innovations enable financial software providers to offer their clients targeted, high-impact value.

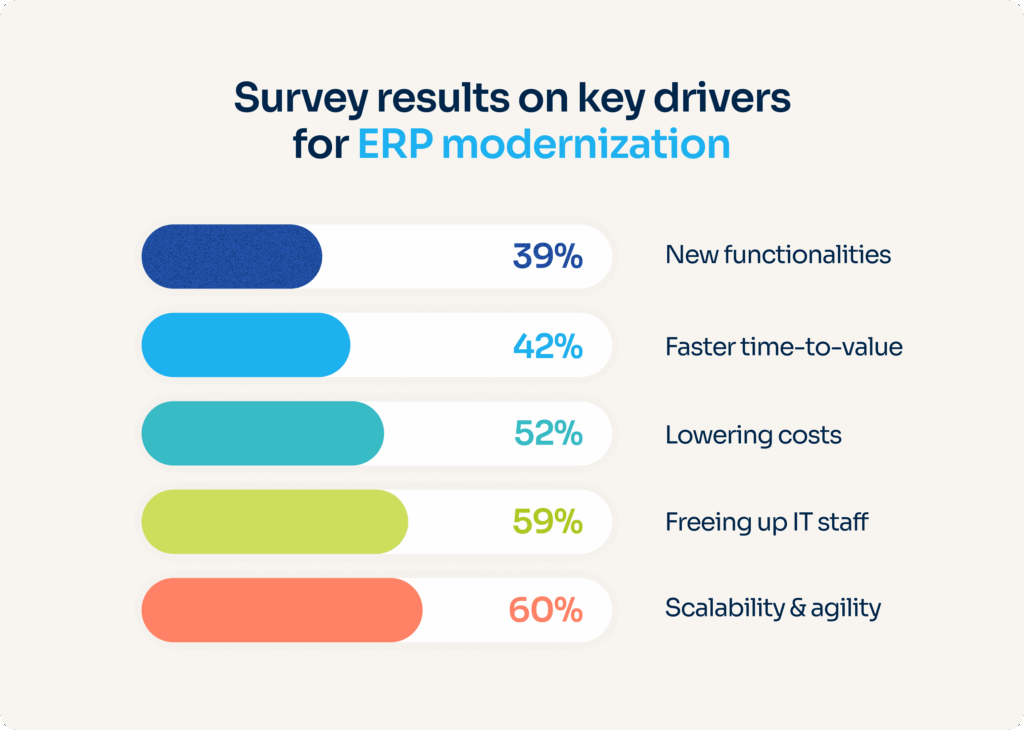

In a Deloitte survey of 100 ERP technology decision-makers, 60% of respondents named improvements to scalability and agility as a main driver for ERP modernization. Other leading drivers included freeing up IT staff (59%), lowering operating costs (52%), simplifying time-to-value (42%), and enabling integrations of new functionalities (39%).

Technologies such as data aggregation APIs and Open Banking connections are pivotal in transforming manual reconciliation processes, enabling systems to retrieve, structure, and process financial data automatically and without human error. For financial software providers, implementing automation can help attract new clients and increase revenue.

How can process automation in financial ERP systems benefit financial software providers?

Financial management software falls into three main categories: accounting, cash management, and ERP. Each presents unique challenges that automation can help solve for them or their customers.

Let’s take a closer look at these three industries:

1. Accounting software

- Customers save time, reduce errors, and increase reconciliation efficiency

- They also get real-time visibility and instant insights into their customers’ payment status

- They improve payment collection and optimize cash flow management

Accounting software providers handle many essential financial management tasks on behalf of their clients, from day-to-day bookkeeping to generating detailed financial reports.

Automation of bank data aggregation and reconciliation enables accounting software systems to fetch bank transactions in real-time and automatically match them with billing and invoice data. This is made possible through integrations with APIs, Open Banking protocols, and payment service providers (PSPs) like Powens, which supply transaction metadata for precise matching. Such capabilities reduce manual workload, improve matching accuracy, and enhance the overall efficiency of reconciliation workflows. With user consent, these systems also connect to bank accounts via Open Banking and Open Finance technologies, automating the retrieval of financial data.

For instance, accountants at Dougs, an accounting software vendor that collaborates with Powens to retrieve transactions and automate financial statements, process an average of 250 balance sheets per year – compared to just 30–40 processed sheets by those working at traditional companies.

Another key advantage of automation for accounting software is real-time data, which can provide instant insights into the current financial situation of an SME. Real-time visibility allows accounting software providers to facilitate faster decision-making for their clients. This level of automation, driven by scheduled data syncs and embedded payment integrations, also supports timely payments and optimized cash flow management by reflecting up-to-date financial status.

2. Cash management software

Like accounting software, traditional cash management software systems require manual data entry and collection.

Automation reimagines this process, enabling businesses to:

- Monitor and manage cash flows across different accounts

- Allow fast transactions with up-to-date cash flow data for end-users

- Reduce fraud exposure through secure APIs and Open Banking protocols that limit manual data handling and enforce strong user authentication

With automation, cash management software providers can enable speedy transactions for their end-users, such as businesses needing quick access to funds. Powered by real-time data aggregation and transaction monitoring tools, automation also provides up-to-date cash flow data. This allows cash management software providers to guide clients on optimal money movements to avoid liquidity gaps or cash surpluses.

Moreover, automation for cash management software offers a more secure digital environment powered by APIs. By implementing an automated platform solution, cash management software providers can lessen their exposure to fraud and reduce the risk of unauthorized data access.

3. ERPs

ERP systems have traditionally been weighed down by slow, manual workflows, data silos, and an overwhelming dependence on legacy systems.

Process automation within ERP software changes the game by:

- Eliminating manual data entry and unifying financial information via real-time data aggregation tools and APIs.

- Automating reconciliation and bookkeeping to cut error rates and repetitive admin

- Providing real-time cash position updates to support smarter, faster financial decisions

- Streamlining onboarding and compliance through seamless access to verified bank identity data and automated checks

With a modern, automated ERP solution, financial software providers can deliver the kind of visibility, control, and speed that businesses now expect. Automated ERPs save time and unlock new revenue streams, giving providers a clear competitive edge.

Financial software providers using platforms like Powens can connect ERP systems directly to their clients’ bank accounts, instantly import transaction data, and automate complex reconciliations – no more emailing spreadsheets or manual uploads.

The result is less time spent handling data and more time focused on analysis, planning, and strategic growth.

Powens drives accounting management software innovation

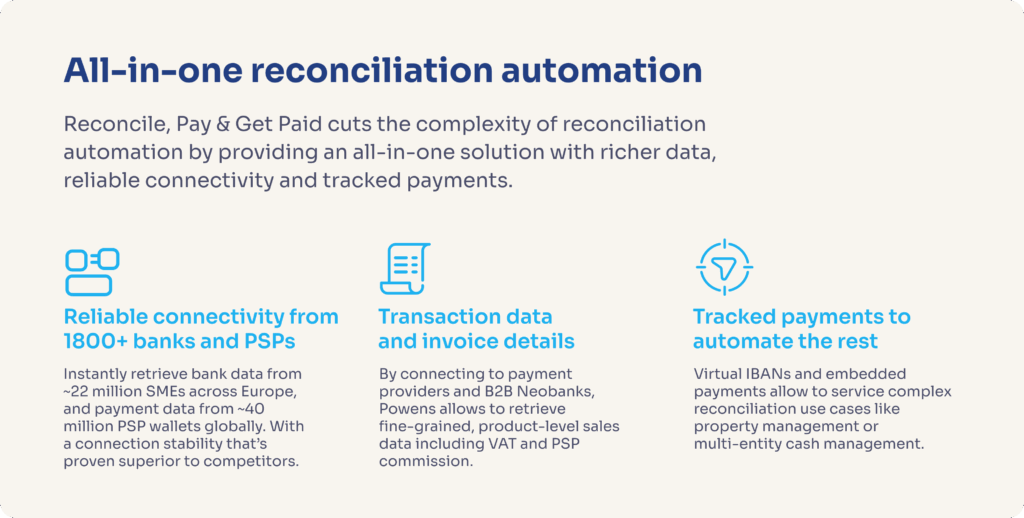

At Powens, our Reconcile, Pay & Get Paid solution empowers accounting management software firms to take full advantage of automation. Reconcile, Pay & Get Paid is designed to automate accounts payable (AP) and accounts receivable (AR) reconciliation, end-to-end. This API-first solution allows financial software providers to instantly access transaction and invoice data via Open Banking and PSP integrations (including Stripe and PayPal). It also enables payment tracking with embedded pay-in methods such as virtual IBANs, SEPA Direct Debit, and payment links.

By connecting all of a company’s bank and payment apps in one place, Reconcile, Pay & Get Paid allows accounting, ERP, and cash management platforms to:

- Fetch real-time, structured financial data from 1,800+ banks and PSPs

- Match transactions with customer and supplier invoices using enriched metadata

- Track payouts and PSP transfers across multiple channels

- Automate the creation of reconciliation-ready accounting & cash reports and exports

- Enable seamless collection and payments through embedded payment methods

This all-in-one platform supports faster closings, cleaner books, and fewer manual tasks. And with features like Webview (a widget for compliant end-user consent) and advanced dashboards for payment monitoring, your teams can onboard faster, resolve errors quicker, and deliver a more intuitive user experience.

Reconcile, Pay & Get Paid brings together everything you need to automate accounting and payment reconciliation – helping you cut development time, improve connectivity, and open new revenue streams.

Book a demo with Powens today to begin automating your financial software products.

Nov 24, 2025

Nov 24, 2025