In 2015, Florent, Luc, Sarah, Patrick and Véronique set up Dougs, an online accounting firm, to simplify the lives of entrepreneurs. No more manual entry, transparent rates, registration in minutes, zero paperwork, responsive customer support and commitment-free service: all these promises were made possible thanks to digitalization, automation and Powens’ API.

The need: create an accounting service adapted to small businesses

The founders of Dougs saw that the existing accounting solutions were not adapted to the needs of entrepreneurs:

- They are expensive;

- They require significant processing time, both for the entrepreneur and for the accountant (entry, sending manual invoices, etc.);

- They do not give entrepreneurs visibility over the company’s situation before the close of the financial year.

Dougs provides an answer to these problems: The online accounting firm improves the customer experience through online registration and tracking, while reducing costs and eliminating manual processes. These services are built on Powens’ banking aggregation technology.

The solution: banking aggregation to transmit customer data in real-time

Thanks to Powens’ Bank Open Banking product, Dougs automatically retrieves its customers’ bank data. In practice, how does it work?

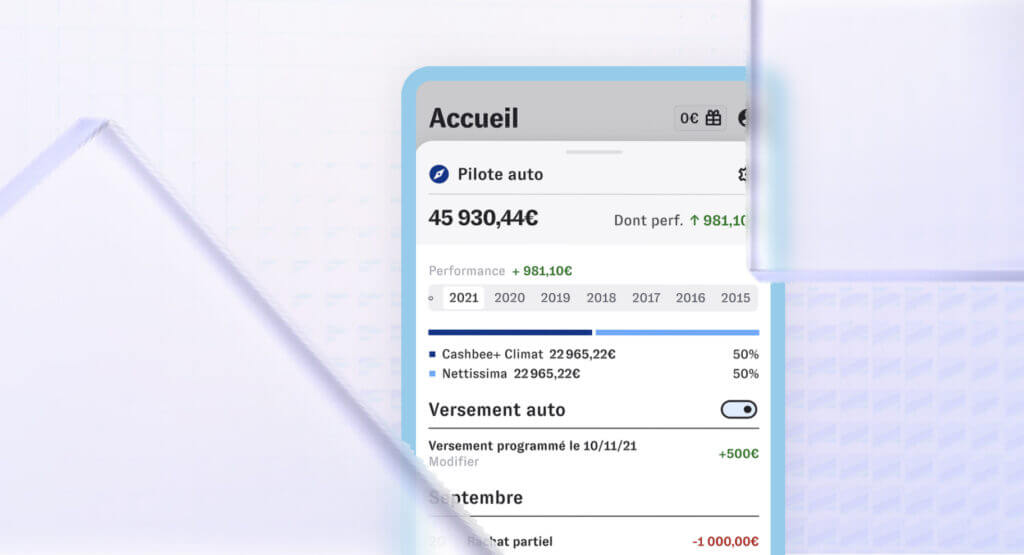

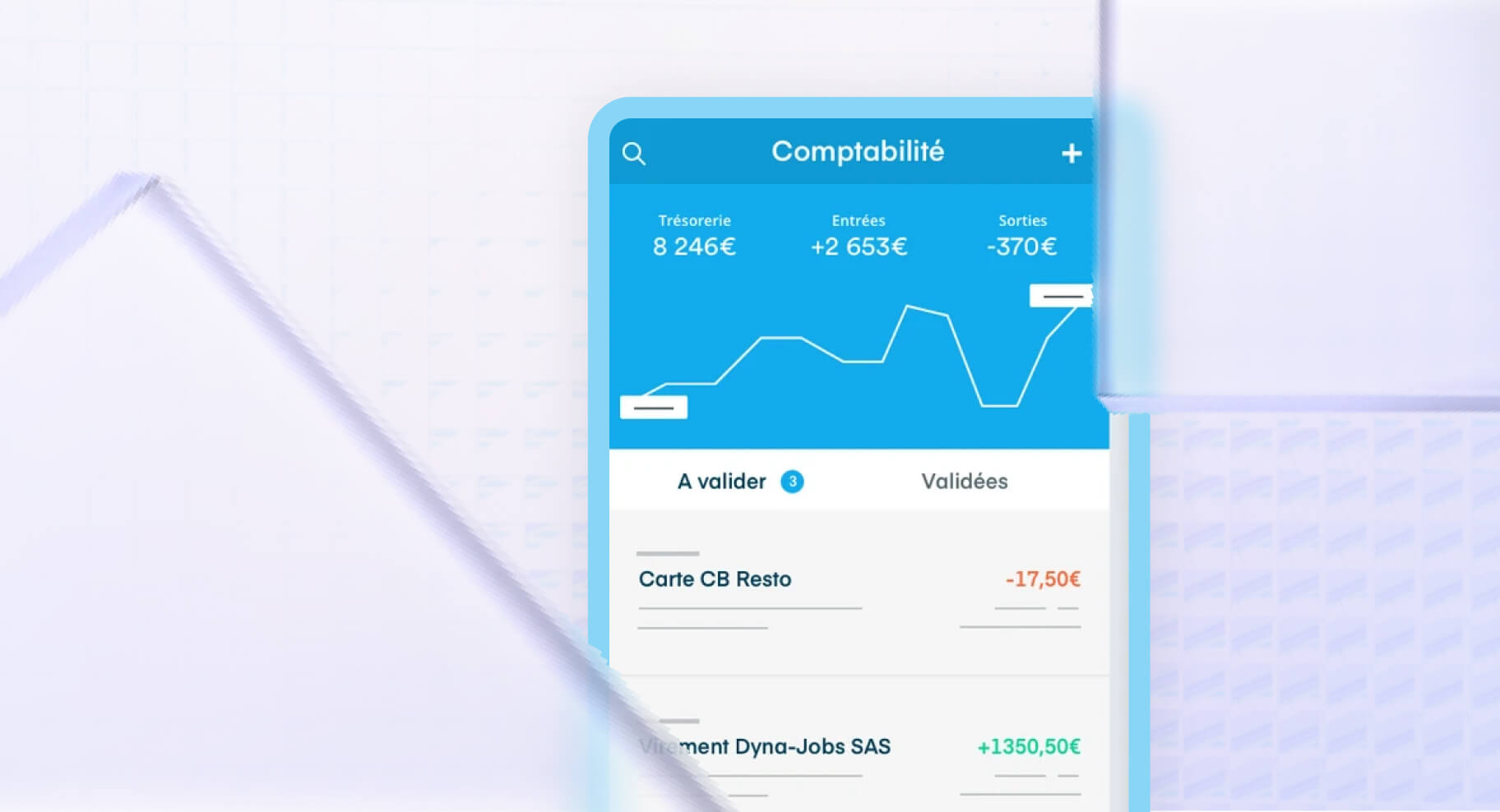

- The online interface synchronizes with the professional bank accounts of Dougs users.

- Transaction information and related documents (invoices) are automatically retrieved from these bank data.

- The result: accounting is performed in real-time, as the transactions arise.

By eliminating low value-added tasks (manual entry) and by automating accounting, entrepreneurs pay between 4 and 5 times less for their accounting services. Added to this is a better experience, both for the customer and for their accountant.

The data from banking aggregation also make it possible to provide an additional service: a dashboard with the company’s main financial indicators. Turnover, margin, operating income… Entrepreneurs can consult all these figures at a glance, with data updated in real-time.

“Banking aggregation is at the heart of our business. Bank enables us to retrieve all the transactions we present in our application, and it is our basis for automating financial statements. By enriching the data retrieved with our algorithms, we facilitate the preparation of financial statements.”

Florent Galland, co-founder, Dougs

The results

Thanks to banking aggregation, entrepreneurs now have an accounting service adapted to their needs. Dougs brings simplification, but also transparency to accounting processes.

Accounting employees also gain in productivity: From 30 to 40 balance sheets per year in traditional firms, Dougs’ accountants can process an average of 250 balance sheets per year.

Figures 2022

- 14,000 customers, x3.5 between 2020

and 2022 - +700 new monthly users on average

- 4 to 5 times cheaper than traditional solutions

- 11,000 balance sheets processed annually, i.e. 6 times more than traditional solutions

Dougs’ ambition is to become the leader in online accounting. For this, its founders rely on the increasingly important automation of balance sheets so that their employees can focus on providing advice to customers.

Want to boost your management solution?

Schedule a demo

Oct 17, 2022

Oct 17, 2022