For five years now, we’ve been witnessing budget and wealth management apps enter the mainstream. Finary in France, Plum or Emma in the UK, and YNAB or Cleo in the US now gather tens of millions of active users. More importantly, the level of knowledge those companies have collected about their customers is enormous – feeding a virtuous circle of UX improvement and experience personalization.

Growth has also been continuous. The global personal finance management (PFM) app market reached over $105B in 2024 and is projected to continue growing at a rate of over 25% annually until 2031. At Powens, we see a 50% year-on-year growth in account connectivity usage for savings and wealth.

But reaching this kind of success is not a given. Especially when you’re not a startup creating a budget app from scratch, with unlimited agility and technical speed. While some traditional banks have managed to provide clear and effective money management features in their mobile banking platforms (Chase or Capital One are often quoted as good examples), most of the time, users are not that interested, and engagement levels are low.

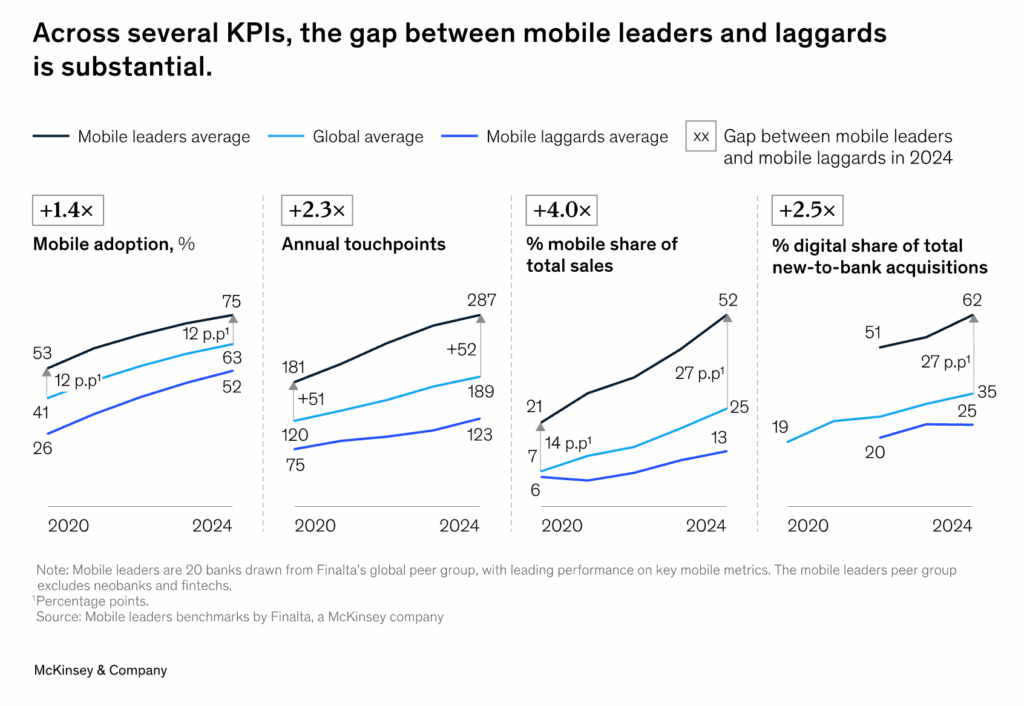

It’s easy to imagine how disappointing it is for a bank that has invested large budgets, time, and brand image to support user features that are ultimately not used that much. At the same time, when done right, budgeting and savings management features can have a massive impact, from customers’ loyalty to brand image – as evidenced by McKinsey’s recent market research on “mobile leaders”.

But what exactly does “done right” mean?

Our answer is: focus, anticipate, deliver iteratively. We’ve supported dozens of personal finance management projects for banks, and witnessed several times how the “one-super-app-for-everything” ambition can cripple projects, or result in a mobile app that does everything averagely – and not a single thing perfectly.

In this guide, we draw on our 10+ years of experience to outline three best practices that will help your institution build a PFM that avoids these pitfalls and delivers measurable results.

1. Set clear & measurable objectives

What’s the #1 reason why software projects fail?

According to BCG research, it’s a lack of clarity and alignment on business outcomes.

A well-defined objective gives your personal finance app a clear purpose and helps set better expectations for users as well as internal stakeholders (tech team and business sponsorship). Also, this objective must be perfectly aligned with the broader strategy of the bank. This will secure a stronger, long-lasting internal sponsorship – a very valuable asset when driving digital projects that encounter many roadblocks and iterations.

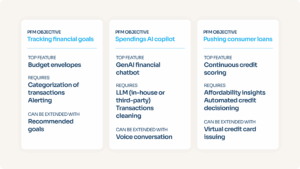

Let’s look at three good examples:

It’s easy to see how, then, those objectives will result in a clearer, more focused set of features and overall UX for the PFM. Designers and developers will be able to create user journeys with a clear intent.

Let’s draw an example with two of the banks mentioned below: the regional retail bank (focused on financial advice by advisors) and the global one (focused on loans).

In the first example, the PFM’s primary goal is to track users’ financial goals and help them stay on budget. To meet this goal, the PFM employs a variety of alerts and financial tracking tools to notify users when they’re approaching their budget, whether they’re on track for the month, and so on.

The second example focuses on the more complex goal of pushing consumer loans. When dealing with lending use cases, your personal finance app must both encourage users to take out small loans while also ensuring you meet all compliance requirements for properly informing customers of loan terms.

What both of these examples showcase is the importance of specific (vs generic) objectives to design outcome-based user journeys. It is those user journeys that will drive user engagement – because they have been taken by the hand and guided in a clear direction.

Having sharp objectives will help you measure them more effectively. Ideally, you would designate one metric as your “North Star KPI” that keeps you on track with your primary goal. For instance, if your PFM’s objective is to track financial goals and increase customer interactions with advisors, then your North Star KPI could be the monthly number of customer interactions with advisors initiated through the app.

Here’s how North Star KPIs could be streamlining your PFM objectives and strategic execution:

2. De-risk early

The three biggest risks your PFM will face are: low user engagement, legal and security roadblocks, and sponsor fatigue. Let’s look at each of these and how to prevent them below.

Low user engagement

The most important risk is simply user adoption and engagement.

A PFM can become a revenue black hole if no one actually uses the app. This makes your user engagement rate matter exponentially, especially in the beginning when you are first launching the personal finance app.

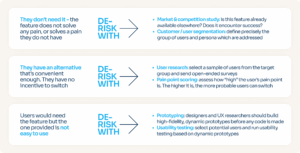

Common reasons users don’t engage with PFMs and how to de-risk them:

As the image above shows, the most typical causes of low PFM engagement are:

As the image above shows, the most typical causes of low PFM engagement are:

- Misalignment: Not solving any relevant pain point with your PFM and its features

- Lack of incentive: Users already leveraging better alternative solutions and/or having little incentive to switch to yours

- Bad UX: It’s too difficult to use your PFM, making even interesting features obsolete

To counter these risks, you first need to do your homework properly via market and competition studies, user segmentation and research, and problem analysis. This ensures that the pain points you solve and the solution you build provide enough value for your customers to actually use it. After that, you have to turn your attention from user adoption to boosting UX by setting up prototypes and running usability tests.

Legal & security roadblocks

Legal compliance is the next big risk roadblock to address after user adoption and engagement.

Inadequate preparation for legal and regulatory requirements such as GDPR, PSD2, and PSD3 can stop a personal finance app project in its tracks. Data protection, data security, and AML and CFT policies can all drastically impact how your PFM operates and what services it can offer to your customers.

Sponsor fatigue

Lastly, we have sponsor fatigue.

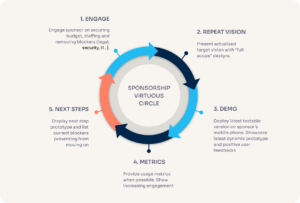

You can’t expect your personal finance app to become a national or global phenomenon overnight. Good digital work takes time, and you need to give your PFM project the time it needs to develop a strong user base and undergo a few rounds of live testing and updating. The only problem is that your sponsors need regular attention. Slowing momentum can turn them off without clear and regular communication.

Maintaining your sponsor relationships requires an approach that is both qualitative and quantitative.

- Engage with sponsors to secure budget and team capacity and remove potential roadblocks

- Share updated visions, including “full scope” designs

- Demo the latest prototype with sponsors and highlight positive user feedback

- Provide metrics on rising user engagement

- Outline next steps in terms of prototypes and blockers to tackle

3. Keep it simple & focus

Your fastest path to failure is trying to make your personal finance app do it all.

Rather than an everything-in-one super app, focus on developing the top feature for achieving the specific objective you have set for your PFM. Along with identifying this feature, you should also research the technology and expertise needed to implement it, as well as potential options to extend the feature.

Below are three examples of how to plan your PFM’s top feature around the main objective:

We recommend following the “buy heavy generic, build light custom” rule of thumb, meaning: Outsource the app development of complex, generic capabilities such as account aggregation and data enrichment, which providers like Powens deliver at scale, and focus your internal resources on lighter, customer-facing features that make your PFM unique.

The final point of focus to prioritize is beta testing. Private (or “beta”) versions of your app can be released to small, controlled subsets of users to test out the effectiveness and success of its features. During these initial test releases, you can gather critical feedback that can help you to improve both the app itself and the user journey it provides.

Ideally, you should have an expansive analytics and reporting dashboard for keeping up with your beta tests, user feedback, and other key pieces of information.

Patience is the true best practice

Our experience shows that typical PFM projects take 2-3 years to deliver significant results.

Developing a personal finance app is not a fast pass to wealth and success. What it is, however, is a direct channel for communicating with your customers and deepening those relationships in a meaningful way.

As discussed in the second best practice, you need to manage your sponsors’ expectations.

Pitching a PFM as a fountain of engagement only to turn around and struggle with user adoption for the first year is a good way to lose sponsor interest and trust. This ties back to the first best practice of setting clear and measurable objectives. Clarity around project goals not only keeps your teams aligned in their efforts but also gives the sponsor a realistic outlook on your project roadmap and growth strategy.

Thinking back to the third and final best practice, simplicity is always king. You never want to overcomplicate your PFM initiative to the point that sponsors no longer see the benefit.

Just remember the three key pieces to creating personalized PFM experiences that convert:

- Maintain a primary objective for your PFM project

- Define the top feature that can achieve that objective

- Determine the required skills and resources for development and expansion

Your next steps

Creating a retail banking PFM can be of great long-term benefit to your institution.

Before you can begin the developmental process, the most important step is to spend some time researching what your customers want in terms of PFM features and functionalities.

Product launch efficiency is, of course, important as well. The faster you can get your PFM into the beta testing stage, the sooner you can make impactful changes to your application’s design that will help to increase user adoption and overall customer engagement.

So, where do you begin?

Recall the tip “buy heavy, build light.” Don’t waste unnecessary time and resources on complex technical tasks like account aggregation or spending categorization. Leave those jobs to an established platform provider that can not only offer aggregation capabilities but also track your PFM data and KPIs through an intuitive dashboard.

To start building your PFM, you’ll need the right provider to give you a strong technological foundation.

Meet Powens’ Finance Co-Pilot, your PFM accelerator

PFMs can be a true competitive differentiator for your bank when you take the time to optimize them.

At Powens, we’ve been at the forefront of the Open Finance revolution for over 12 years, partnering with more than 10 leading banks and hundreds of other industry participants to deliver innovative PFM solutions that drive real business results.

We package all our PFM expertise into Finance Co-Pilot, our business-oriented product designed for retail banks and fintechs that want to launch differentiated personal finance apps.

Finance Co-Pilot brings together several key capabilities to help you deliver value fast:

- Financial data aggregation and data visualizations: Connect to 1,800+ banks and investment platforms across Europe to unify account, savings, loan, and investment data in one place.

- Automatic and manual categorizations of income and expenses: Simplify categorization and take it one step further with data enrichments like affordability checks and risk reports.

- Spending and budget alerts: Enable users to define budgets and receive alerts for key events such as incoming paychecks, overspending, or low balances.

Beyond these core capabilities, Finance Co-Pilot gives you a solid foundation for continuous improvement. With real-time analytics and reporting dashboards, you can update and improve your PFM strategy on demand to keep enhancing the customer experience.

Ready to get your PFM off the ground? Contact Powens today.

FAQs

What are personal financial management apps (PFMs)?

PFMs are mobile-friendly applications that customers can easily access from their smartphones. Through PFM Open Banking capabilities, your clients can even connect multiple accounts to gain a unified and embedded view of their finances, all from one app on their phone or desktop.

Why should retail banks invest in PFMs?

PFMs enable retail banks to offer highly personalized digital experiences that drive user engagement and long-term loyalty. By aggregating customer data from across financial institutions, banks can cross-sell and up-sell more effectively, reduce churn, and differentiate themselves in a competitive market.

How does Powens help banks that want to develop PFMs?

Powens supports retail banks through Finance Co-Pilot, a modular product designed to accelerate PFM development. It delivers core features like account aggregation, transaction categorization, budget alerts, and real-time analytics – allowing banks to launch robust PFMs faster, while focusing on their own customer-facing innovations.

Why is Powens a great account aggregation provider for PFMs?

Powens offers secure and PSD2-compliant access to over 1,800 European financial institutions. Its aggregation engine powers advanced categorization, enriched insights, and seamless UX integration, making it ideal for PFMs that demand scale, precision, and flexibility.

What is Finance Co-Pilot by Powens?

Finance Co-Pilot is Powens’ solution for launching embedded personal finance tools. It combines account aggregation, budgeting, expense tracking, and user alerts in one powerful toolkit, specifically tailored to banks and fintechs looking to build PFMs.

How long does it take to see results from a PFM project?

Based on industry experience, successful PFM initiatives typically take 2–3 years to deliver measurable results. Early KPIs often focus on engagement, with business impact (e.g., cross-sell uplift or retention) visible after broader adoption. Powens helps reduce time-to-value with pre-built modules and proven UX features.

What regions is Powens Finance Co-Pilot available in?

Powens operates across Europe, with connections to over 1,800 banks and financial institutions. Some features are subject to local specificities. Finance Co-Pilot is fully localized and PSD2-compliant, making it ideal for banks in the EU seeking fast deployment across multiple markets.

What should be the main feature of a personal finance app?

Your app’s key feature should directly align with your core business goal – whether that’s helping users manage budgets, identify savings opportunities, or access lending products. For example, a lending-focused PFM might prioritize affordability checks and loan eligibility scoring.

How can a bank reduce risks when launching a PFM?

De-risking starts with solving a real customer pain point and offering superior UX. Banks should also ensure regulatory compliance (GDPR, PSD2, PSD3), test extensively before full rollout, and manage internal sponsor expectations with clear KPIs and timelines.

Can PFMs be used to drive revenue?

Yes. PFMs enable banks to gather deeper financial insights, which can be used to improve cross-selling, promote lending products, or introduce premium features. By improving customer engagement, PFMs become powerful revenue accelerators – not just cost centers.

Oct 28, 2025

Oct 28, 2025