The EU-wide e-invoicing mandate, established by Directive 2014/55/EU, aims to standardize electronic invoicing across member states, with each country adapting the requirements to its specific needs. Here’s how France is implementing this regulation.

What is E-Invoicing in France, and Why is it Important?

France’s e-invoicing reform is overseen by the Ministry for the Economy, Finance and Industrial and Digital Sovereignty, along with the Public Finances Directorate General (DGFiP). The reform is intended to improve the efficiency of business transactions, reduce administrative costs, and ensure better VAT compliance.

The country first transposed the EU directive in 2019 through the Business Growth and Transformation (PACTE) law. Now, with Article 91 of the 2024 amending finance law, France is set to make e-invoicing mandatory for all B2B transactions.

New Reform Timeline and Mandate

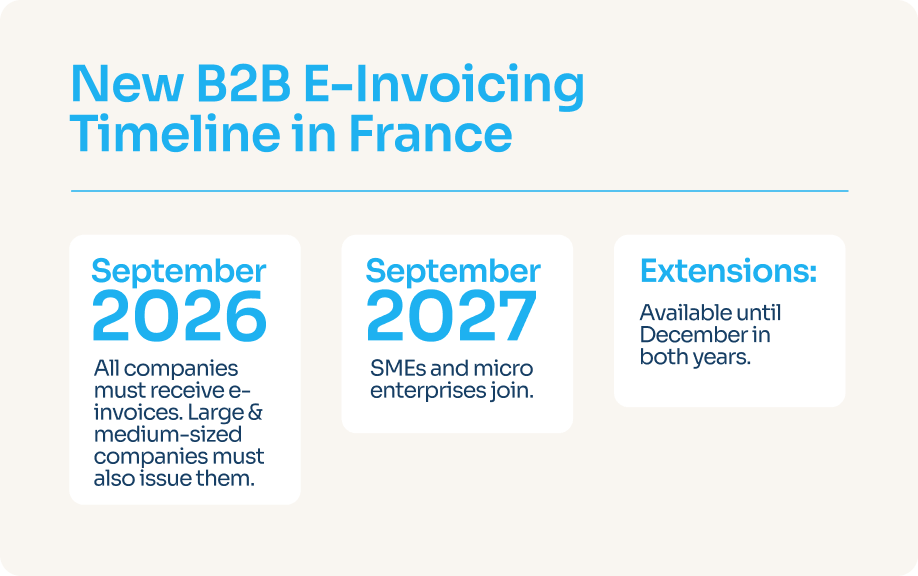

The French government has confirmed the following timeline:

- By September 1, 2026: All businesses must be able to receive e-invoices. Large and medium-sized companies will also be required to issue them.

- By September 1, 2027: Small businesses and microenterprises must comply, with the option to extend until December 2027.

These timelines are crucial for companies to plan their transition and ensure compliance with the new regulations.

End of the Public Invoicing Portal (PPF)

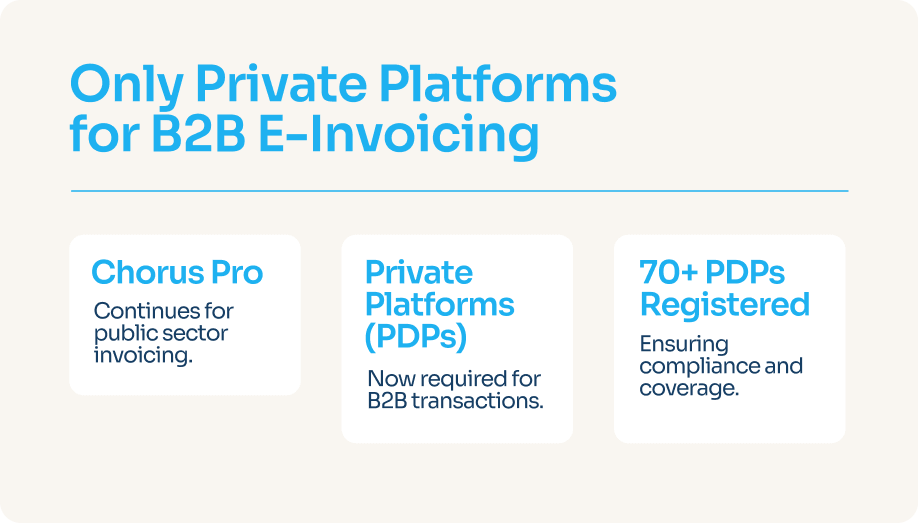

A significant change in the reform is the cancellation of the public invoicing portal (PPF) as a platform for issuing or receiving invoices.

Previously, the French government considered using a central platform like Chorus Pro, which currently handles invoicing for public sector transactions. Chorus Pro remains relevant for invoices submitted to public authorities, allowing suppliers to send invoices to government entities.

However, with the new B2B e-invoicing mandate, only certified private platforms (PDPs) will manage B2B invoicing. Over 70 PDPs have been registered, demonstrating strong engagement from the private sector. Businesses will need to use a PDP for compliance with the new B2B rules.

Key Infrastructure Developments

To facilitate the transition, the government will establish a centralized recipient registry and a data concentrator. These will enable secure exchanges between PDPs and ensure proper data transmission to the tax authorities.

What is E-Reporting in France?

In addition to e-invoicing, France is implementing new e-reporting obligations, which will cover:

- B2C sales

- International B2B transactions

- Intra-EU supplies

- Payment details for VAT-eligible services

The deadlines mirror the e-invoicing schedule, with reporting becoming mandatory in September 2026 for larger businesses and September 2027 for smaller firms.

How Powens helps Financial Management Software simplify compliance with the new French mandate

“We use Powens’ Bank product in order to synchronize banking transactions flow in real-time- Through this synchronization, our solution performs a bank reconciliation between invoices and transactions of our customers. And that’s not all: access to bank data has enabled us to create a cash management tool which automatically categorizes expenses” Jean-Pierre Ocalan – iPaidThat CTO and Co-Founder

For many financial software, complying with the French e-invoicing regulation efficiently can seem daunting. But it doesn’t have to be. Powens provides financial management platforms with powerful Open Finance and Embedded Banking solutions designed to streamline e-invoicing and align with new regulations.

By integrating Powens’ solutions, financial softwares can empower their users with:

- Real-time banking data and cash flow monitoring

- Automated reconciliation and payment processes

- Regulation-compliant solutions for managing payments and collections in the SEPA region

Ready to make compliance simple? Talk to our sales team today to discover how Powens can transform your approach to e-invoicing.

Oct 18, 2024

Oct 18, 2024