Grisbee Embraces Open Finance to Provide Personalized Wealth Management Consulting Services

Portfolio wealth management is both an art and a science because a customer’s asset and investment portfolio can often include a number of dynamic and complex elements that can shift daily. For financial advisors, providing accurate and reliable portfolio analysis requires having access to the most up-to-date financial data at all times. Unfortunately, collecting this information manually—which is how the industry has done it for years—has never been an efficient way to either stay on top of ever-changing market conditions or address real-time customer needs. This is precisely why Grisbee was founded on the promise of bringing wealth management into the digital age. To accomplish this, they needed to tap into the power of Open Finance and looked no further than Powens to support their data aggregation needs.

The Need: A fully digital way to collect, analyze, and update multiple financial data sources, all in real-time

Before financial advisors can provide meaningful counsel to customers on how to optimize their portfolio, they first need to collect all relevant financial inputs: banking accounts, savings accounts, insurance, assets, and investments. Unfortunately, this is typically time-consuming for financial advisors, especially when the data collected must be processed manually.

The typical process for collecting this data in traditional wealth management firms might go something like this: 1) An financial advisor will ask customers to share all their financial data and documentation, at which points 2) the financial advisor consolidates this information into a spreadsheet (or similar) to begin piecing together a complete financial profile for the customer.

This approach to data collection and analysis is riddled with problems. First, it’s inherently inefficient and time-consuming, both for the customer and the financial advisor. Second, it’s completely manual, which is naturally prone to human error. And finally, it’s completely analog, requiring customers to update their information frequently, especially in times when their financial situation changes significantly. This, therefore, begs the question: How can a financial advisor provide actionable advice to customers if the information they have to work with is inaccurate or out-of-date? This is exactly what Grisbee, in its role as an online wealth management consulting firm, set out to solve.

The Solution: Open Finance for automating the aggregation of bank, savings, and investment account data

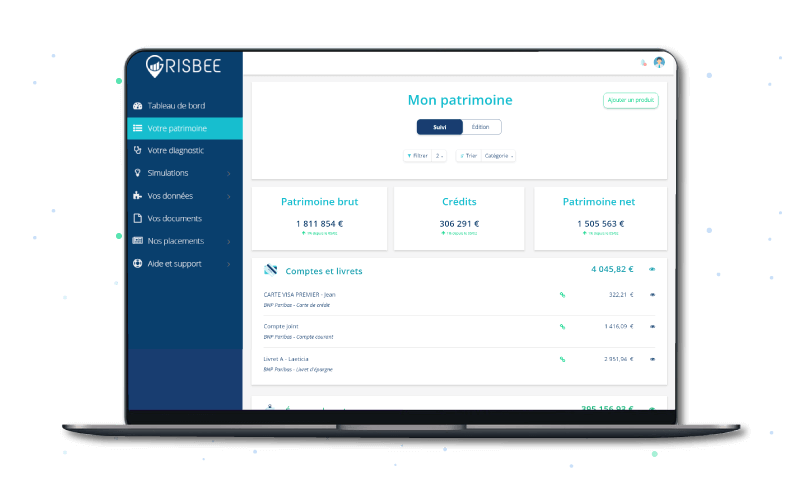

When Grisbee first opened its doors in 2016, the business’s founders wanted to take an entirely different approach to wealth management, one that seamlessly blended innovative technology with a specific focus on providing customers with expert counsel. To do this, they built a powerful platform that could easily ingest all data related to a customer’s assets and investments in one convenient place. And they made it accessible to all at no cost—because they knew that once customers visualized all of their assets organized within the platform, they would be motivated to work with a dedicated financial advisor to make sense of it all.

By tapping into the power of Powens’ Bank and Wealth data aggregation products, Grisbee has eliminated manual data-sharing processes of the past with an automated, real-time solution that ensures both customers and financial advisors have instant access to the most accurate and up-to-date information at all times. And because both parties share the same dashboard view, they can collaborate more effectively on financial decision-making to minimize risks, boost investment performance, and reduce fees or other tax burdens.

And as the cherry on top, since the data in the platform is constantly being updated in real-time, financial advisors can now receive alerts whenever something changes on their customers’ end. This allows them to be proactive with recommendations around how to evolve current strategies to maximize the short- and long-term success of their customers’ investments.

The Results: Empowering financial advisors to provide customers with dedicated support, service, and counsel

In just a few years, Grisbee has succeeded in becoming the leading fully digital wealth and asset management coach in France, having managed more than €9B of assets and investments for over 170K users on their platform. And although customers may have been a bit reluctant in the early days to share their data online, now that they’ve trusted the process, they’ve become addicted to the speed and simplicity of it all. They see the value in Grisbee’s offer and understand that good decision-making comes down to analyzing great data. (Not to mention, they’re also quite content to ditch their Excel spreadsheets once and for all, too!)

But what makes Grisbee’s service a real industry game-changer is how this automation and centralization of banking, savings, insurance, asset, and investment data allows the company’s financial advisors to do what they do best: provide proactive expert wealth management counsel in real-time. Instead of wasting hours inputting or updating customer data—in addition to the time spent requesting that information from customers—Grisbee’s dedicated financial advisors can focus all of their attention on customer success.

- 170K users on Grisbee’s platform

- €150M worth of assets currently under management

- €9B worth of assets consolidated on Grisbee’s platform since 2016

” Real-time savings and investment data aggregation is at the core of our business. Without Powens’ Open Finance solutions, it would have been nearly impossible to centralize all of a customer’s assets and investments in one place while keeping it updated at all times. This has empowered our financial advisors to do what they do best: help customers make better financial decisions that drive long-term value out of their investments. ”

Frédéric Billot de Lochner, Founder and Associate Director at Grisbee.

Ready to transform your business with the power of Open Finance

Contact our team today to schedule a demo of our Open Finance products and services.

Feb 13, 2023

Feb 13, 2023