- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- DevelopersInitiate payments, and aggregate all the financial data and documents you need from over 1800 institutions using a single API and unified development environment.

- Clients

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- Connect

- FREE TRIAL

- Log in

- English

Europe-wide coverage

Our Open Finance API connects to 2000+ financial institutions across Europe.

Exhaustive Data

Our real-time transaction data is cleaned and standardized so you can be confident you’re working with relevant and timely data.

Simple integration. Quick onboarding.

Go live in less than a day with our interactive integration guide and free real-life testing environment.

What’s in Bank?

Individual & business

Retrieve all user’s current accounts with superior balance & identification data.

- Instant snapshot of a user’s multiple current accounts with IBANs

- Rich balance attributes: historical, coming, available

- Point-in-time query to retrieve historical data

At least three months’ history of transaction data. Daily updates.

- Operation date, amount, currency, label and transaction type (card, transfer, deposit…)

- Deferred debit transactions

- Up to four data updates per day

How customers connect their accounts to your apps

We ensure all user accounts are easy to connect and always available.

{

"transactions": [

{

"id": 56789,

"wording": "Paiement Acme",

"date": "2020-09-15",

"rdate": "2020-09-16",

"value": -56.78,

"type": "card",

…

},

…

],

"first_date": "2017-02-14",

"last_date": "2020-09-15",

"result_min_date": "2020-08-30",

"result_max_date": "2020-09-30"

}

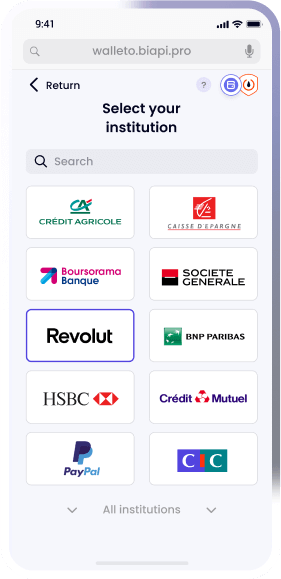

1

Security & consent

We take your users by the hand by building trust and making sure they consent with confidence.

2

Bank selection

Users quickly find their bank: we highlight popular ones and provide a blazing-fast search experience.

3

Authentication

App-to-app, web redirection, embedded: our API makes it easy to fine-tune the perfect authentication flow for each use case.

4

Account selection

Users can select only the bank accounts they wish to share, making our consent flow fully GDPR-compliant.

5

That’s it!

After the user validated through the bank’s mobile app or SMS code, transactions and balances are instantly retrieved and the user is redirected to your app or website.

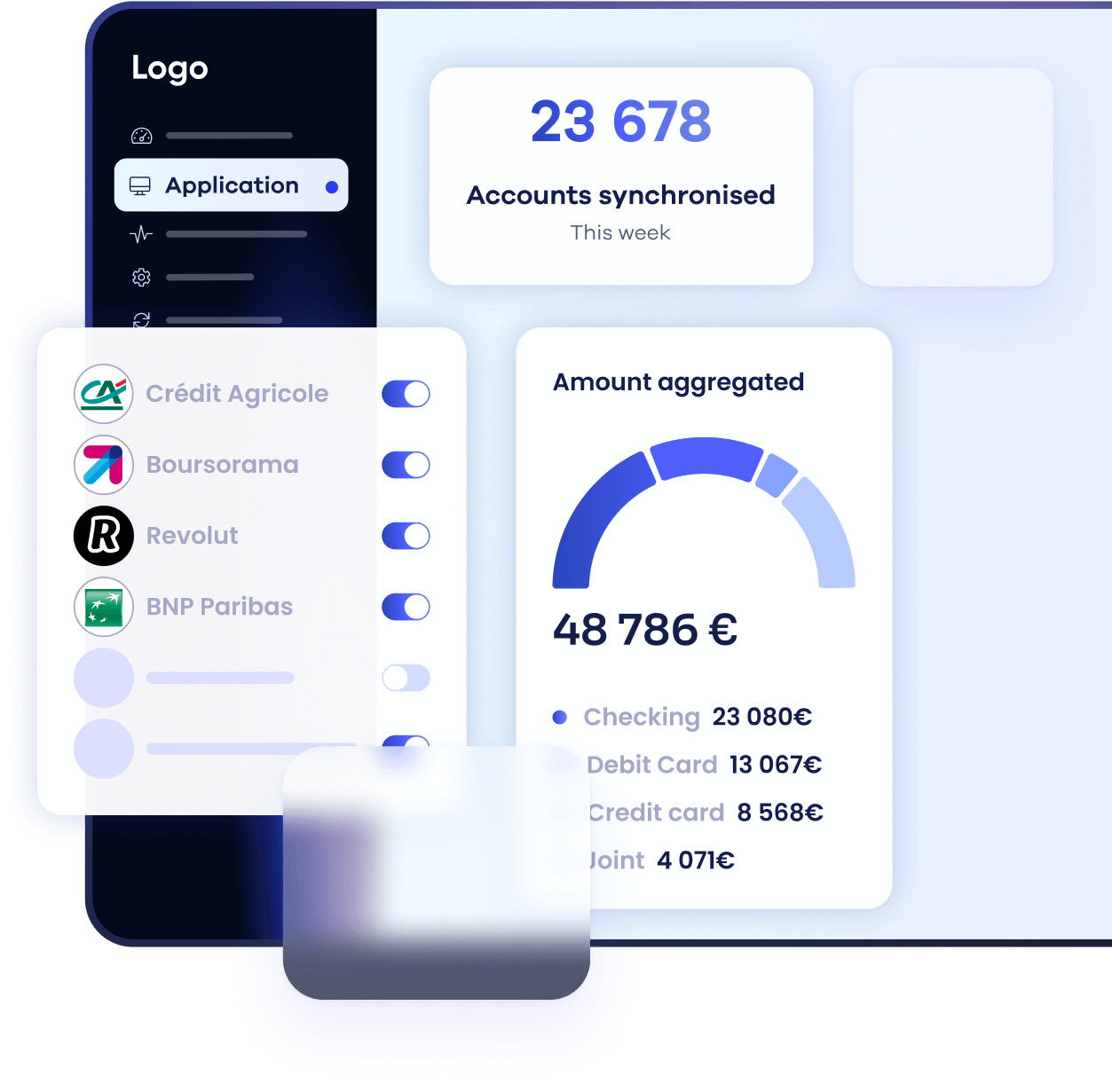

Powens console

User-friendly configuration of your domains, client applications, webhooks, and connectors. Complete monitoring of connection statues.

Create an account and let us guide you

Setup a free sandbox in just a few clicks and use the wizard to easily test our API with real-life scenarios.

Configure

Adapt the user flow to maximize success rates. Choose the capabilities and banks to activate.

Monitor

Check bank sync usage and keep an eye on health status reports.

Analyze

Visualize key metrics & trends to optimize your Open Finance experience (amounts , users, conversion rates...)

Why Powens ?

2000+

Institutions

10bn+

Transactions processed

15bn+

Monthly refreshes

99.9%

Uptime across Europe

Safe

Secure & PSD2 compliant

Top use cases using Bank