Our technology is aimed at both large institutions and startups. We are proud to provide the necessary infrastructure for launching innovative companies like Ownily. Ownily’s mission is to facilitate the management of “SCIs” (Sociétés Civiles Immobilières), a rather specialized type of French family-owned company for the ownership and management of real estate. This solution is the first of its kind in France and represents a new use case for our API!

Caroline Bosser, co-founder and director of Ownily, discusses the creation of her solution as well as our partnership.

How did the project to create Ownily come about?

In 2018, while working in the Commercial Department of Crédit Mutuel of Bretagne, the banking arm of the Crédit Mutuel Arkéa group, I was asked to participate in a think tank on the market for asset holding companies and civil companies.

The initial project was to democratize the use of investment companies (i.e., “sociétés civiles”) linked to SCIs and to study how the Crédit Mutuel Arkéa group could offer new pathways to facilitate access to these entities.

During the prototyping phase, the project was repositioned to simplify the management of family-owned real estate companies in order to remove barriers to entry and accelerate the establishment of these types of companies. Not all SCI owners are supported by accountants, tax lawyers, or rental management service providers.

Instead, many of them opt for autonomous management and end up having difficulties with certain obligations and/or tax returns. These difficulties can generate legal and financial risks and harm the profitability of their assets or the SCI’s goals and objectives.

Until now, this customer segment has not been addressed. However, the SCI market is extremely valuable. They’re investors with potential needs for financing, insurance, and legal protection, and it was this realization which led to the creation of Ownily in 2020. The solution has since been acquired by the IZIMMO group, a subsidiary of the Crédit Mutuel Arkéa group, which will now market Ownily to SCI owners, either directly or through prescriber partners.

How does Ownily help optimize the management of real estate companies?

The objective is to facilitate the administrative management and financial steering of SCIs. In concrete terms, the aim is to assist owners throughout the year with bookkeeping, preparing tax returns, issuing receipts, and managing general meetings.

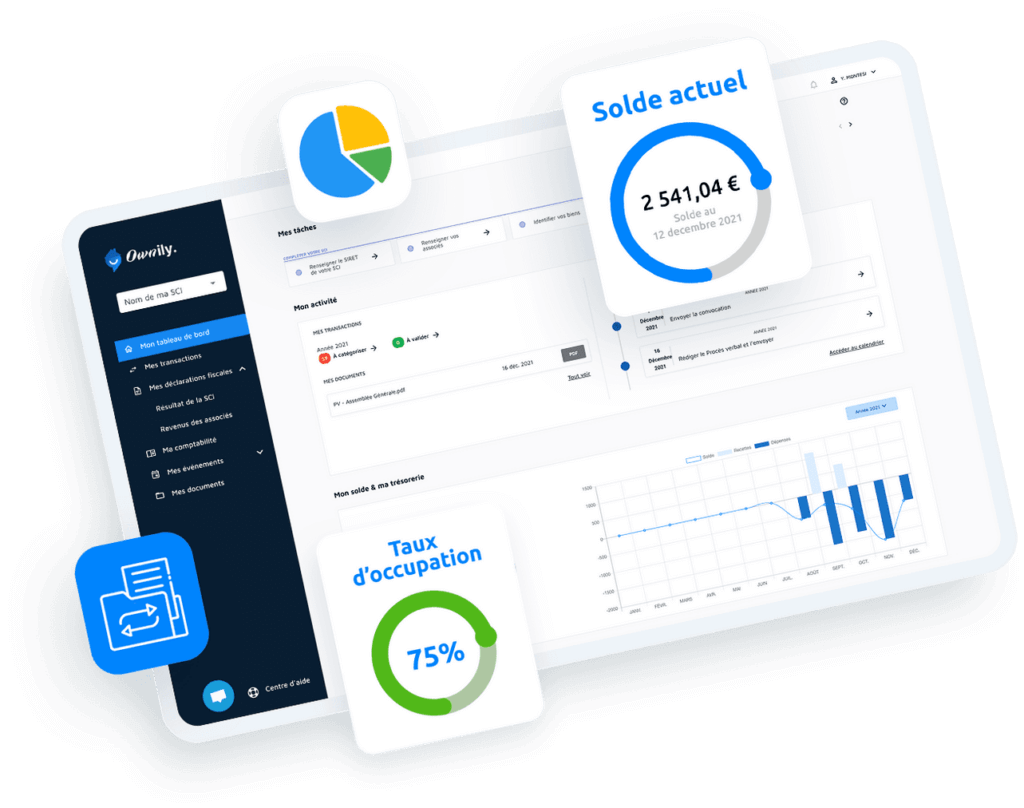

The Ownily platform offers SCI owners real-time centralization of all banking transactions and documents on a single interface. This allows them to manage their cash flows more proactively while eliminating the need for manual data entry. In addition, Ownily allows them to efficiently perform bank reconciliations. They no longer need to download their bank statements or keep track of transactions in an Excel file.

Additionally, SCI owners can share access to the platform with their partners and soon with a trusted third party such as an accountant. This way, everyone benefits from the same information. Ownily facilitates communication and the meeting of deadlines.

What’s our contribution?

The dedicated team was involved very early on, from the POC (Proof Of Concept) design stage, in order to help us build the crux of the solution. As such, we were able to benefit from synergies within the Crédit Mutuel Arkéa group.

We quickly integrated Budget Insight’s API with the Bank product to retrieve the SCI’s banking transactions in real-time and bring them together on a single dashboard.

Ownily is currently in its infancy with the launch of the platform in January 2022. Right now, we’re in the seed stage and are looking at next steps, including automation of loan classifications. Indeed, many customer flows are real estate or construction loan maturities with different components, depending on the type of loan and banking institution. The Budget Insight Team is working with us on new features that will allow us to automate the processing of these maturities from an accounting standpoint.

Current balance, occupancy rate

Early feedback from users is encouraging:

“Being able to easily categorize my transactions is really what I was looking for.”

“Ownily is more user-friendly than the software I had been using, and I can access it from anywhere.“

“Until now, I had been doing all my calculations manually. With Ownily, it’s convenient having everything in one place, and I can avoid typing errors.“

We also plan to accelerate the distribution of Ownily through a network of partners (e.g. accountants) who can use our solution as an intermediary service to facilitate the exchange of information with their family-owned real estate companies owner clients.

Let’s reinvent financial services together!

Want to design the best wealth management experience?

Get in touch

Apr 25, 2022

Apr 25, 2022