We’re simplifying payments and financial planning with an upcoming link to receive payments and a loan amortization feature

Coming soon: New ways to pay!

In response to customer feedback, we are pleased to announce the anticipated release of our latest feature “PayByLink” from Powens!

Most businesses are familiar with the process of their clients making payments by clicking on a link in an invoice or payment request and then inputting their credit card details to initiate a transaction. To streamline this, using Open Banking technology, PayByLink merges the advantages of PIS payments with the benefits of direct link payments, giving end users a fluid and intuitive payment experience. Users can complete transactions in just a few clicks, without having to manually enter their payment details each time.

There are numerous benefits to this feature. PayByLink reduces time spent on payments, avoids human error associated with repeated manual input of banking details, and saves businesses money by eliminating credit card or wire transfer transaction fees since our product Pay includes a flat fee per transaction instead of a percentage of the total amounts.

Along with these advantages is having the ability to pay when you want. Before today, payment links remained open to payments for only 30 minutes. This created complications because there was no guarantee that a client would click on the link in the invoice to make a payment within the 30-minute window. But now, in the event of an initial payment failure or delay, users can simply try again via the same payment link. Links remain active indefinitely, giving users the option of paying at any time, without time restrictions.

PayByLink has gone through beta testing and we look forward to a full release in the coming weeks. Stay tuned!

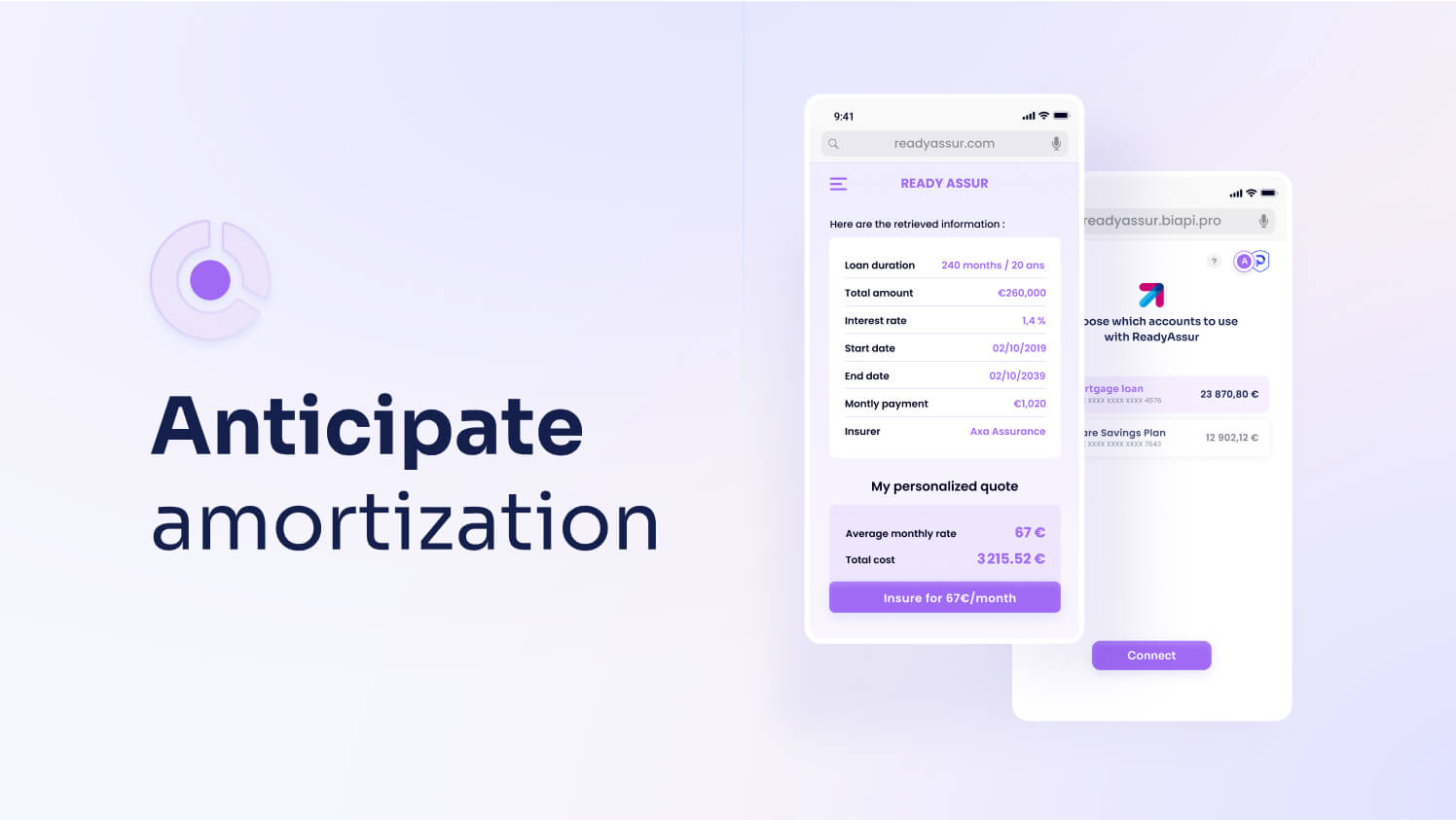

Anticipate loan amortization

A large part of financial management involves repaying loans and having a full view of both your current and future financial outlook. To help our customers in this effort, the product managers and designers have been diligently working on a new feature for the API that will make managing your finances a cinch!

The new loan amortization feature will extract data from amortization PDFs that include payment schedules. After extraction, the data is redistributed through our API, making it possible for users to see their full payment schedule and budget accordingly.

This will allow users to

- Anticipate when their loans are fully repaid

- Get a full understanding of the money they will gain after repayment, and

- Estimate when they can refinance

And all of this will be in one place!

We’re looking forward to giving you an update on the launch of this product feature very soon.

What can Open Banking do for your business?

Start benefiting from Open Banking today! Contact one of our specialists to begin your journey to better customer service and innovative payment solutions with Powens.

Feb 27, 2024

Feb 27, 2024