“New and Improved” is the name of the game for this quarter’s product release. Discover the latest updates to our product line.

Introducing New Balances

Get a more accurate view of your financial outlook

Accuracy is the lifeblood of business. If nothing adds up, entire operations are stalled.

Improving accuracy is one of the main use cases provided by Open Banking. The technology demonstrated immediate value by giving accounting software access to relevant, up-to-date financial data. With Open Banking, managing money and reviewing transactions went from a slow process based on file exchange with banks to a real-time, API-based connectivity. As a result, processes were automated and streamlined, helping companies reduce manual errors and cut costs.

Powens has remained at the forefront of accounting solution innovation, supercharging bookkeeping, pre-accounting, and reconciliation. This has given several companies the shot in the arm needed to gain more customers, funding, and influence. But, we’re not the type of company that rests on our laurels. We want to do more…

…and 2024 is the year of more!

Introducing updated Balances, the latest feature of Bank from Powens.

With our new Balances feature, you can now access to the balances and their reference dates provided by the bank which will allow you to get a more accurate view of the current and expected balance before and after all transactions have been processed. This updated accuracy brings several benefits to the table.

Know exactly the amount of money at your disposal

Get a true sense of what you can do with your remaining balance, without worrying about any unforeseen payments. A more comprehensive view of the financial activity for your clients to enrich cash flow management and better projections.

Open up payment flexibility

Having both your current and future balance displayed in one place gives you the flexibility needed to anticipate a future book balance, and schedule future payments accordingly.

Accurate affordability analysis

Lenders today need to make near-real-time decisions, so having a true picture on a borrower’s ability to repay is key. Retrieving the upcoming balance in addition to the book balance gives lenders access to the true availabie amount of funds in the user account.

There’s no better time to improve your business operations than now. Bank from Powens is the best solution for your accounting needs.

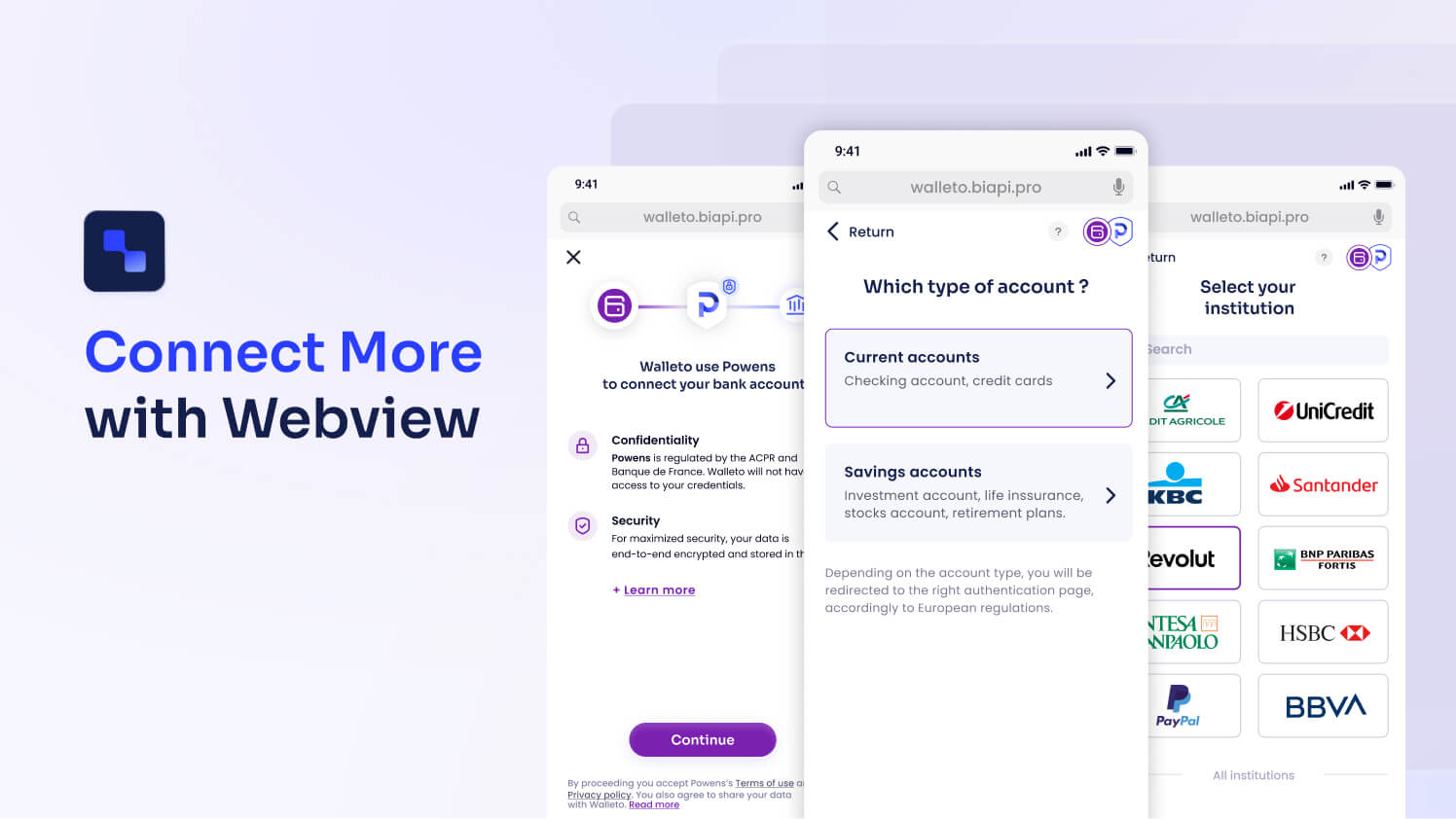

Connect More with Webview

Add multiple institutions and accounts in one session, and create multiple URL links for customized configurations.

One session. Many connections. Add multiple institutions and accounts in one session in our One Way Webview.

On average, Bank & Wealth customers synch more than five bank accounts, often from different institutions. Before now, the process of connecting multiple accounts was not very fluid. You had two options:

- Use our Webview Manage to allow PSUs to add a new connection,

or

- Implement a transition page in your interface to propose to allow PSUs to reopen Webview Connect and restart an authentication process to add a new institution.

These were practical solutions, but we knew we could improve it. As you can see, this is not practical. Setting this up required additional development, which created additional problems with PSUs.

Now with our One Way Webview, one component allows you to add accounts, offering users a smoother, faster experience, and as always, it’s fully compliant with PSD2.

Check out our video announcement here. Follow the guide to start connecting your accounts today!

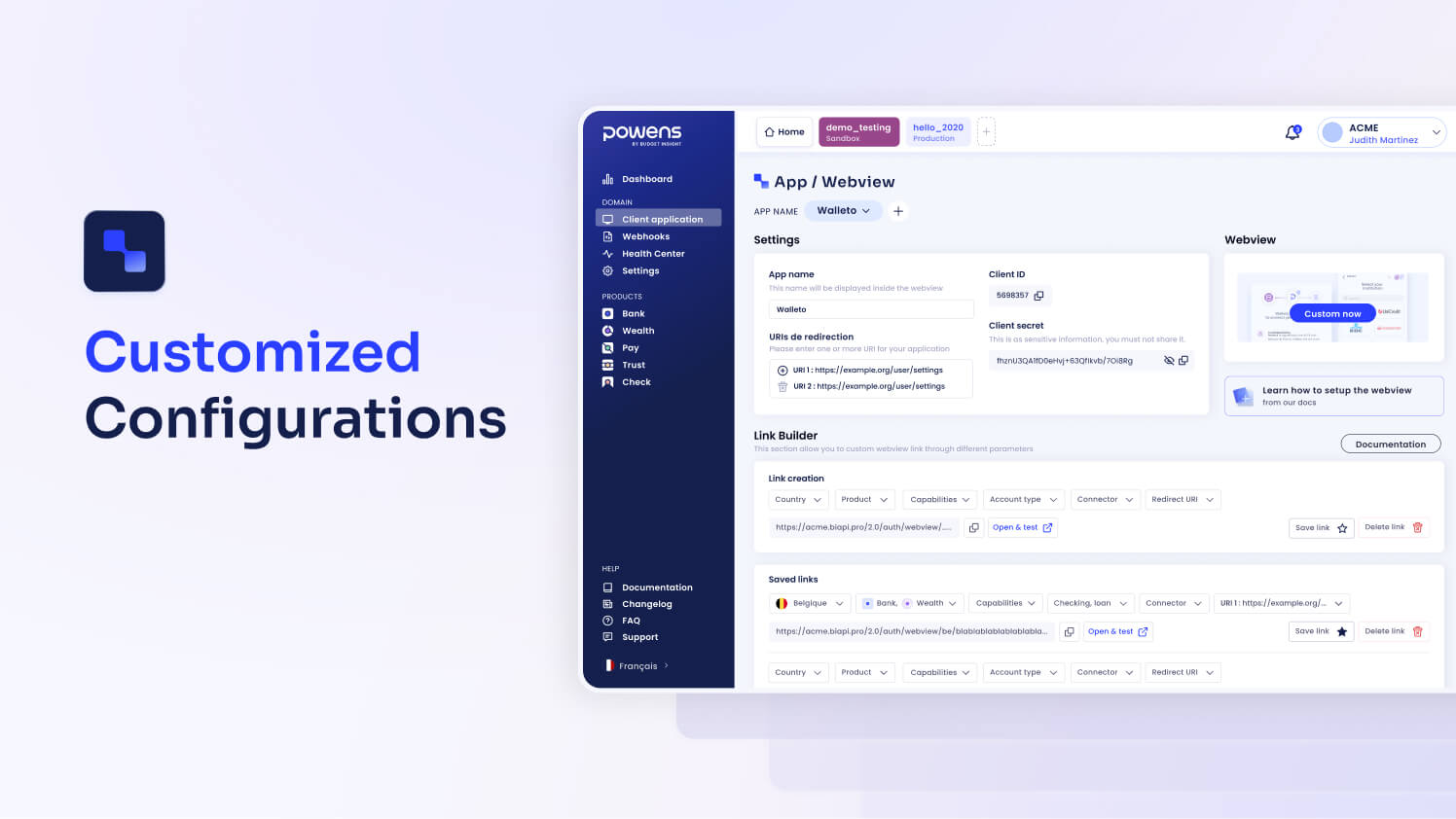

A Custom Link Builder, with No Codding Needed

Let’s get straight to the point. After all, Open Banking is here to simplify processes. But, some platforms, products, and APIs have a tough learning curve. At Powens, we work hard so that you don’t have to. This is what motivates us to give you the best user experience in the industry.

To get you where you want to be, we’re adding a new feature, with no codding required. Coming out of beta testing and getting ready for launch is our Custom Link Builder in Webview. You build the URL, and it will open the Webview in the mode of your choice. Go directly to Bank mode, or Wealth mode, or even Webview in a different language.

Many of you have tested it, and your feedback has been extremely positive. Custom Link Builder is included in the application part of your Administration Console. From there, and you can test dozens of different configurations with ease!

Log on to create your first link, or contact your CSM for more information.

Bank Advanced is live!

Released before the end of the year, Bank Advanced is our latest product offering that gives you an all-in-one package of essential B2B bank aggregation connectivity. This includes PSP connectivity, invoice attachments, and transaction metadata from neobanks and PSPs.

Several of our customers in the accounting software industry upgraded immediately upon Bank Advanced release, and are already benefiting from the added benefit of providing their customers extended capabilities for real time bank reconciliation.

Don’t miss out! Read the official announcement here.

Seize the opportunity

It’s always the right time to improve customer service with our cutting-edge solutions. You can take advantage of these features and more with Open Banking from Powens. Send us a note here below and one of our experts will get in contact with you.

Jan 30, 2024

Jan 30, 2024