Natixis Interépargne is the leader in employee savings management in France. Natixis Interépargne was a pioneer in this field and the first to enable a saver to transfer money to his/her employee savings account with a credit card. It is also the first institution to have set up an employee savings account aggregator. This builds on Powens’ ability to aggregate data beyond PSD2.

The need: give employees a consolidated view of their employee savings

Career paths are less and less linear. The share of employees who spend their entire career in the same company is decreasing. Each time an employee changes company, they get a new employee savings account, retirement savings account, or an account for the numerous other corporate savings schemes. Each time, it means there is a new platform to connect to, access codes to remember, and the need to switch between interfaces to see all of the employee’s savings. In short, a complex and time-consuming task.

In addition, until the Pacte Act (France’s Law on Business Growth and Transformation), it was impossible to transfer one’s ‘Article 83’ retirement contracts. Employees were looking for a simple solution to access all of their employee savings accounts in one place.

To address this need, Natixis Interépargne set up an employee savings aggregator, based on Powens’ Open Finance technology.

The solution: Open Finance for easy management of employee savings

With the Natixis Interépargne app, savers can get a consolidated view over all their employee savings accounts. Users can activate the service in 3 minutes:

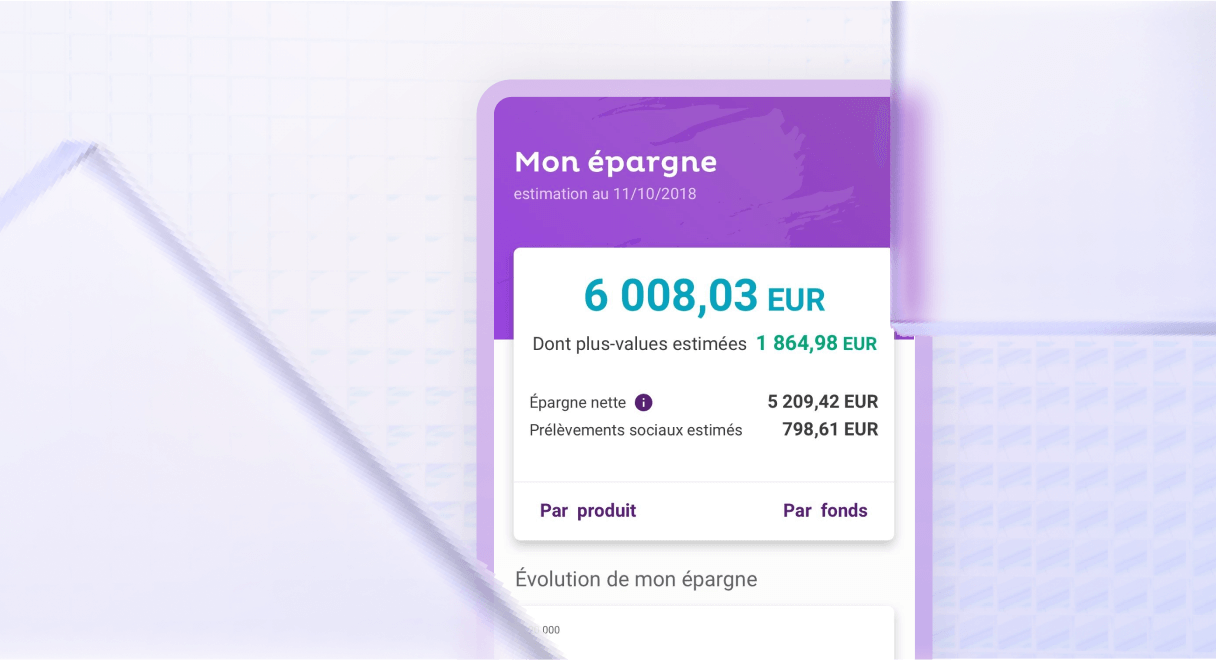

- They link up their various employee and retirement savings accounts using Wealth, Powens’ savings and investment data aggregation product;

- They get a view over all their employee savings accounts: employee savings, retirement savings, supplementary pension funds or free shares, all on one single interface;

- They can see how their savings are broken down, by product and account manager, and can compare the performance of their different investments.

The teams at Natixis Interépargne and Powens have worked together to enrich the information collected by the API. Performance, SRRI, recommended investment horizons, capital gains: the user accesses all the data at a glance.

“We worked hand in hand to leverage our synergies: we have the business expertise, and Powens, the technical expertise. Powens’ renowned financial data aggregation know-how, its ability to upgrade the API to enable us to collect very specific data, and the possibility of developing new connectors to meet our needs sealed the deal. ”

Patrick Alaguero, Customer experience Project Manager, Natixis Interépargne

The results

The service created by Natixis Interépargne, with Powens technology, meets a real need. It simplifies the lives of employees. By having an aggregated view of all their employee savings schemes, they can make rapid and informed decisions.

The figures: December 2021

- More than 74,000 corporate customers offer this service to their employees.

- more than 3 million savers

- less than 3 minutes to activate the service

Do you want to tap into the potential of Open Finance?

Schedule a demo with a Powens expert.

Nov 22, 2022

Nov 22, 2022